- Moving the markets

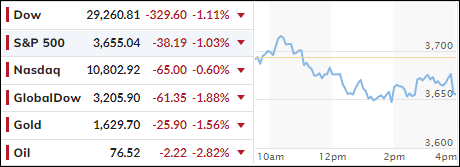

Equities took in on the chin again with the major indexes notching another loss, as interest rates rose among unrest in a variety of global currencies. The British Pound (BP) had at one point fallen 4% against the Dollar but came off its lows on rumors of the Bank of England having to raise more aggressively to battle inflation. Amazingly, the BP is now within striking distance of parity with the dollar, while the Yuan is heading towards all-time lows.

As the Fed has continued its aggressive hiking campaign, the US Dollar’s surge has ravaged many other currencies, most notably the Euro, which has now hit a low not seen since 2002.

The S&P is homing in on the June lows and at one point briefly fell below that low point of the year, but the index closed slightly above it. Sometimes, those lows can serve as a support level for a rebound but, given the current economic and financial environment, I believe the odds of a breakthrough to lower prices are greater than a recovery.

Supporting my view is the action in the bond markets where yields spiked with the 10-year topping 3.9% at one point during the session, which was its highest level since 2010. The 2-year yield, which is more aligned with Fed policy, surpassed 4.3%, as MarketWatch noted, the highest level since 2007.

After last week’s brutal spanking, the downward trend continues with stocks and bonds seemingly getting clobbered in sync, while Gold is being pushed down to invalidate it as an alternative investment, a condition that will not last forever. Even Crude Oil was not exempt from bearish forces and was pulled below the $80 level.

I will be out tomorrow to be able to fully “engage” with my scheduled colonoscopy (humor attempt), but I will return Wednesday for the market report.

Read More