ETF Tracker StatSheet

You can view the latest version here.

ENDING THE WEEK WITH A BOOM

- Moving the markets

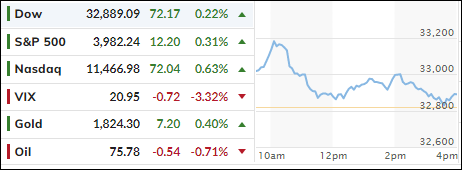

Yesterday, I had to laugh out loud when one’s man’s opinion caused bullish juices to suddenly explode, after the markets had been chopping around aimlessly for the most of the session.

Bloomberg’s headline featuring the Atlanta Fed President Bostic as saying, “FED COULD BE IN POSITION TO PAUSE BY MID TO LATE SUMMER,” created a buying panic, and up we went, with the major indexes scoring solid gains.

Never mind that Bostic did not say those words, but only commented that “FED HAS WAYS TO GO IN RAISING INTEREST RATES,” and “HIGHER RATE END POINT COULD BE NEEDED if economy shows more strength.”

And that’s how you prop up a sinking market. Go figure…

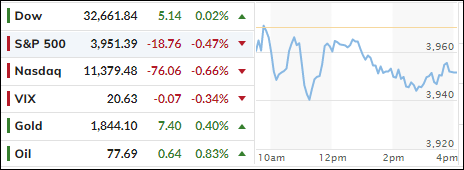

That positive close carried over into today’s session when retreating bond yields gave an assist and propelled equities higher, as the 10-year dropped below the 4% level to 3.97%, which in trader’s eyes represents a critical dividing point. The Dow managed to break a 4-week losing streak, while the S&P 500 snapped a 3-week decline.

Today’s Ramp-A-Thon went on, despite a slew of hawkish messages from the Fed’s mouthpieces. ZeroHedge summed it up like this:

The Fed said in its semi-annual report to Congress released Friday, “The committee is strongly committed to returning inflation to its 2% objective.”

Officials expect that “ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive.”

At 11ET, Dallas Fed’s Logan warned that “The US financial system has become increasingly vulnerable to core market dysfunction…” but did not address monetary policy

At 13ET, Boston Fed’s Collins said, “more work to do“, adding that additional rate-hikes are needed to cool prices, inflation remains too high. “I anticipate that reducing inflation back to target will require additional federal funds rate increases to bring interest rates to a sufficiently restrictive level, and then holding there for some perhaps extended time.”

Additionally, former Treasury Sec Larry Summers told Bloomberg TV that “The Fed right now should have the door wide open to a 50 basis-point move in March,” adding that “they have not been this far behind the curve for a year or so.”

Yet, none of the above hawkish comments were able to keep the rally in check, as traders and algos only focused on Bostic’s comments yesterday and slightly retreating bond yields today. Of course, with a strong short squeeze, anything is possible and today was no exception, despite inflation expectations having surged again.

The US Dollar broke down today and lost almost 1% for the week, which gave Gold some life, and the precious metal surged over 2% this week.

To me, it’s very clear that there will be no Fed pivot for some time to come, yet stocks have refused to cope with that reality leaving me pondering when this gap will snap shut.

Read More