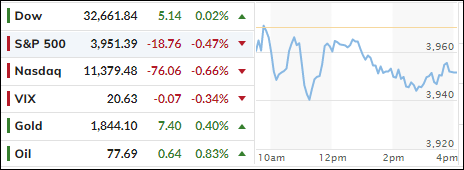

- Moving the markets

Higher interest rates have been pummeling equities all last year, as most bounces ended up reversing and creating lower lows. While the Dow managed to climb temporarily into the green today, the S&P and Nasdaq struggled below their respective unchanged lines with bullish sentiment being suspiciously absent.

The culprit was surging bond yields with the 10-year climbing above its much-watched 4% level but closed a tad below it. This was the 10-year’s first break above it since November. Minneapolis Fed President Kashkari opined that he was “open to the possibility of a larger interest rate hike at this month’s meeting.”

As Bloomberg reported, his focus was inflation, rates, and the economy, and he was as outspoken as ever:

- *KASHKARI: DON’T WANT RECESSION BUT SLOWING INFLATION IS JOB ONE

- *KASHKARI: DON’T OVERREACT TO ONE MONTH OF DATA

- *KASHKARI: I LEAN TOWARDS CONTINUING TO HIKE RATES FURTHER

- *KASHKARI: US ECONOMY IS NOT IN A RECESSION RIGHT NOW

- *KASHKARI: DON’T KNOW IF FED CAN ACHIEVE A SOFT ECONOMIC LANDING

- *KASHKARI: SOME GROUNDS FOR OPTIMISM BUT WE MUST COOL INFLATION

The opening short squeeze turned out to be head fake and faded into the close. The US Dollar retreated but bobbed and weaved throughout the session. That offered Gold the opportunity to rally with the precious metal gaining 0.40%.

And, as ZeroHedge pointed out, financial conditions are tighten back towards monetary policy reality, which is exactly what Fed head Powell wants. That could imply that the Citi Economic Surprise Index might follow suit, which makes me wonder if that will bring out the “pivot talk” crowd again.

After all, a weak economy needs stimulus via lower rates, which is exactly what the bulls are waiting and hoping for.

2. “Buy” Cycle Suggestions

For the current Buy cycle, which started on 12/1/2022, I suggested you reference my then current StatSheet for ETF selections. However, if you came on board later, you may want to look at the most recent version, which is published and posted every Thursday at 6:30 pm PST.

I also recommend for you to consider your risk tolerance when making your selections by dropping down more towards the middle of the M-Index rankings, should you tend to be more risk adverse. Likewise, a partial initial exposure to the markets, say 33% to start with, will reduce your risk in case of a sudden directional turnaround.

We are living in times of great uncertainty, with economic fundamentals steadily deteriorating, which will eventually affect earnings negatively and, by association, stock prices. I can see this current Buy signal to be short lived, say to the end of the year, and would not be surprised if it ends at some point in January.

In my advisor practice, we are therefore looking for limited exposure in value, some growth and dividend ETFs. Of course, gold has been a core holding for a long time.

With all investments, I recommend the use of a trailing sell stop in the range of 8-12% to limit your downside risk.

3. Trend Tracking Indexes (TTIs)

Our TTIs slid again as today’s rollercoaster ride ended up in the red.

This is how we closed 03/01/2023:

Domestic TTI: +3.46% above its M/A (prior close +3.66%)—Buy signal effective 12/1/2022.

International TTI: +7.02% above its M/A (prior close +6.74%)—Buy signal effective 12/1/2022.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

Contact Ulli