ETF Tracker StatSheet

You can view the latest version here.

CHAOS IN THE MARKETS

- Moving the markets

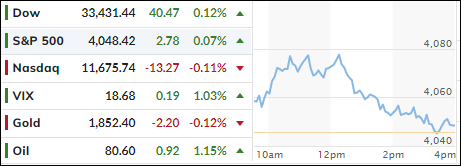

February payrolls came in hotter than expected, which put the markets under pressure after the opening bell rang. 311k jobs were created, well above the consensus of 225k and higher than the hoped-for whisper number of 250k.

Offsetting the idea that good economic news is bad news for the markets was the fact that wage gains were smaller than anticipated, which created hope that the Fed might rethink its aggressive stance on rate hikes. At least that’s what the markets now expect with the terminal rate tumbling 40bps today.

However, the payroll report was quickly pushed to the back burner, as far more pressing events permeated the markets. Yesterday’s troubles at Silicon Valley Bank (SVIB) accelerated, and the FDIC shuttered the bank and appointed a receiver, after depositors had frantically pulled out their money.

ZeroHedge highlighted the events like this:

- *FDIC: SVB BANK CLOSED BY CALIFORNIA REGULATOR

- *FDIC: SVB BANK IS FIRST INSURED INSTITUTION TO FAIL THIS YEAR

- *FDIC CREATES A DEPOSIT INSURANCE NATIONAL BANK OF SANTA CLARA

- *FDIC: NAMED FEDERAL DEPOSIT INSURANCE FDIC AS RECEIVER

- *FDIC CREATES A DEPOSIT INSURANCE NATIONAL BANK OF SANTA CLARA

- *SILICON VALLEY BANK INSURED DEPOSITORS TO HAVE ACCESS MONDAY

The FDIC also noted that SVIB had $175 billion in deposits and pointed out that some $151 billion of those are uninsured. So, if you left our funds in there, you are out of luck and will likely receive zero. Ouch!

The question on traders’ minds is “who’s next?” After all, there is never only one cockroach in a house…

Regional banks tumbled with the banking ETF dropping more 18% this week, while some bank stocks were repeated halted during Friday’s session.

Bond yields dropped sharply, when the flight out of risk assets to the alleged safety of bonds accelerated. Midday, the 2year yield had plunged an amazing 50bps from yesterday’s close, which was the biggest 2-day drop since September 2008.

To no surprise, the biggest winner of the day was Gold, as the precious metal gained 2.14% for the day.

In the end, this was the worst week for stocks in 2023 with the major indexes surrendering over 4%, while SmallCaps took top billing by collapsing 9%.

Read More