- Moving the markets

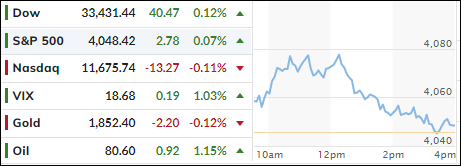

Equities tried to build on last week’s bullish momentum with an early bounce, which coincided with sliding bond yields, as the 10-year slipped towards its 3.9% level.

However, a sudden spike in yields put the bears in charge, as the 10-year ripped off its lows and climbed back towards the 4% marker. That pulled the major indexes off their lofty levels and towards their respective unchanged lines.

In the end, not much was gained or lost. Upcoming events, like Fed head Powell’s congressional testimony on inflation and interest rates, as well as Friday’s jobs report, may have had a negative influence on traders’ and algos’ willingness to commit.

The short squeeze, which usually accompanies early upward momentum, faded fast, as interest rates spiked. The US Dollar went sideways, while Gold slipped a tad after an early bounce.

Clearly, Wall Street was mired in uncertainty, and new directional impetus is needed, as the tug-of-war between bulls and bears continues.

2. “Buy” Cycle Suggestions

For the current Buy cycle, which started on 12/1/2022, I suggested you reference my then current StatSheet for ETF selections. However, if you came on board later, you may want to look at the most recent version, which is published and posted every Thursday at 6:30 pm PST.

I also recommend for you to consider your risk tolerance when making your selections by dropping down more towards the middle of the M-Index rankings, should you tend to be more risk adverse. Likewise, a partial initial exposure to the markets, say 33% to start with, will reduce your risk in case of a sudden directional turnaround.

We are living in times of great uncertainty, with economic fundamentals steadily deteriorating, which will eventually affect earnings negatively and, by association, stock prices. I can see this current Buy signal to be short lived, say to the end of the year, and would not be surprised if it ends at some point in January.

In my advisor practice, we are therefore looking for limited exposure in value, some growth and dividend ETFs. Of course, gold has been a core holding for a long time.

With all investments, I recommend the use of a trailing sell stop in the range of 8-12% to limit your downside risk.

3. Trend Tracking Indexes (TTIs)

Our TTIs offered a mixed picture, with the Domestic one slipping, while the International one managed to eke out a gain.

This is how we closed 03/06/2023:

Domestic TTI: +5.17% above its M/A (prior close +5.67%)—Buy signal effective 12/1/2022.

International TTI: +8.99% above its M/A (prior close +8.66%)—Buy signal effective 12/1/2022.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

Contact Ulli