- Moving the market

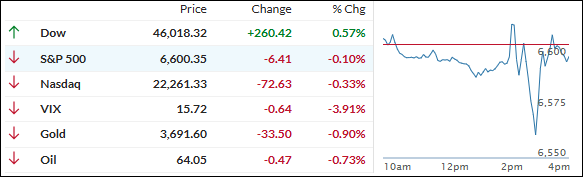

The week got off to a choppy start, with most major indexes opening in the red before regaining their footing.

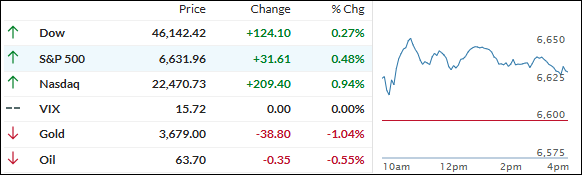

The Nasdaq led the turnaround, clawing back above its unchanged line first and later dragging the Dow and S&P 500 along for the ride.

Despite the bounce, a looming government shutdown kept things from getting too lively—Congress still hasn’t sorted out a funding plan, and the deadline is less than a week away.

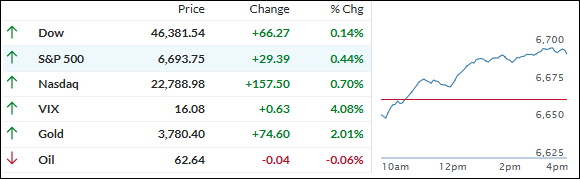

Still, stocks are coming off a strong run. Last week saw record closes for the major indexes, with the Russell 2000 small caps hitting a new high for the first time since 2021.

The Fed’s quarter-point rate cut is freshly baked in, and traders are now pricing in two more cuts by year-end and even more over 2026. But honestly, further gains will likely depend more on solid economic data than just rate moves from here.

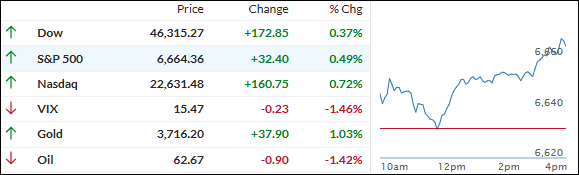

Elsewhere, a short squeeze helped push equities higher today. Nvidia rallied 4% after announcing a strategic OpenAI tie-in, but precious metals stole the show—gold popped 2% to a fresh record above $3,780, and silver jumped over 2.5% to break the $44 mark.

Bond yields drifted a bit higher, while bitcoin dropped further, landing near $111k at a two-week low.

So far, the market’s shrugged off September’s reputation for volatility. The question is, can this momentum last through quarter’s end—or will some of these risks finally break through?

Read More