I have touched on the subject of hedging before, but one reader posted this question:

Can you please clarify what hedging means?

In one of the posts I read:

“The safest and most responsible way to use reverse-index ETFs is to hedge or protect your equity portfolio in a bear market.”Suppose I hold $ x worth of an ETF. How are the following two different from one another?

1. Buying $ x worth of inverse ETF? (This means, whether the market goes up or down, the value of my portfolio remains the same – am I right?)

2. Selling the $ x worth of the ETF and having it in money market.Are not 1 and 2 above the same in terms of value after so many months? (In the case of 1 above -Till the time I liquidate the long or inverse ETF are not 1 and 2 above same?).

In theory, you are correct. The value of a short position is supposed to make up the losses of a long position—if we’re going through a bearish period. This is 100% true if you have two accounts and in one you hold 100 shares of IBM, while in another account, you sold short 100 shares of IBM. The gains and losses will cancel each other out.

However, the story is different when you mix mutual funds and inverse ETFs where the relationship is not exactly definable. That discrepancy can lead to profit opportunities while limiting downside risk. I have done a lot of research in that area, but I can’t share all results yet, since my work is not finished.

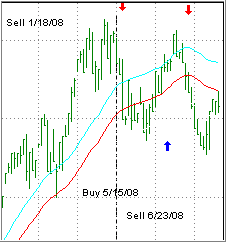

However, I will give you two small opposing examples of how hedging could have produced profits. A few months ago, we’ve had 2 subsequent 3-week periods, one bullish and one bearish, during which I held 2 mutual fund positions, which were hedged with SDS.

First the bullish period:

Please note that during this period, the S&P; 500 gained sharply by rising +6.31%, while the hedged position went up by +3.50%. A month later, the bottom dropped out and during the subsequent bearish period, the numbers changed as follows:

The S&P; 500 lost -5.86%, while the hedged position gained +1.99%. On balance, the hedges produced a profit, while the S&P;’s gains and losses pretty much canceled each other out.

When I picked these periods during my research project, they were selected only because of the market’s sharp rise and fall and not because the hedge results turned out positive. I have looked at hundreds of examples and, while using a hedge like this will not always result in a profitable outcome, the downside risk was sharply reduced, while, at the same time, upside potential was limited.

However, when used over longer periods, including bear markets, the results have been quite impressive because of the reduction in volatility. So hedging will not necessarily put your portfolio in a 100% neutral position, it can also be used to produce profits no matter which way the markets trend.

I currently have no holdings in any of the funds/ETFs mentioned.