Lately, I have been receiving a lot of subscriber email wondering what to do with their invested positions. I personally find it hard to believe how some people subscribe to my free newsletter, which spells out exactly when to buy and sell, and then proceed to do the exact opposite.

Even my constant nagging of using sell stops seems to simply fall on deaf ears.

Consider the latest email from an anonymous reader:

My entire portfolio is invested in the following mutual funds……….would you continue to hold or bail out…….I have emerging Markets……..gold …..energy ……natural resources……..oil and gas…energy services…..oil and gas services, and precious metals and precious minerals………. ………….China ……..India………that is 10 areas. I think that covers it…………..I am getting clobbered ……but I know and feel that these are all areas that are going to rebound…….as soon as the i***t is out of office………

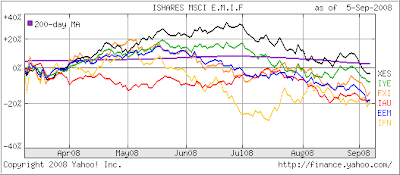

Of course, you are getting clobbered when you’re hanging on to investments that are in severe downtrends. None of these should be held during a bear market. Take a look at a chart:

Had you used my recommended sell stop discipline for sectors and country funds of 10% from the high since you bought them, you’d be 100% in cash right now. You’re playing the game without a plan, based on your wild hope that a new president in office will make all the difference and that your holdings are going to rebound.

While that possibility exists, it’s not a basis for making intelligent investment decisions. This is the exact type of wishful thinking that has killed portfolios during the last bear market of 2000 to 20002. I suggest you re-revisit your ideas and become acquainted with the fact that whatever you do, you should always use a sell stop; it will save your bacon many times.

Your investing style is based on a bullish scenario, which will get clobbered in a bear market environment as you have witnessed. I believe that the bear has a long ways to go, but if I’m wrong, then trend reversals, as shown via my Trend Tracking Indexes (TTIs), will give you the opportunity to re-enter the market at a time when the odds are stacked in your favor.