Lately, I have seen a variety of articles touting the benefits of using target-date funds (also known as Lifestyle or Life-Cycle funds) to reach your retirement goals.

One write-up in particular started out by intelligently stating that “low contribution rates could leave investors with a retirement shortfall.”

Duh!

If I don’t contribute to anything, I’ll be facing some kind of shortage in the future. It doesn’t take a mathematician to arrive at that conclusion. That would apply to any type of investment account, wouldn’t it?

The problem I have with Lifestyle funds is that the investing public is lulled into a false sense of security by believing that this type of fund, if regularly contributed to, will be a “safer” investment than a “regular” mutual fund.

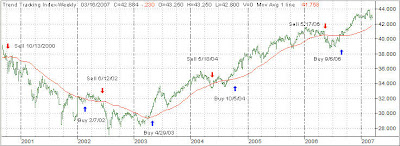

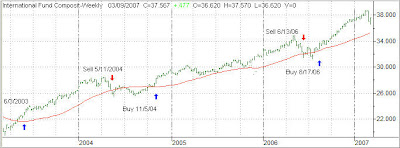

This is absolutely not true. Lifestyle funds go down in value during bear markets just as much as other funds. I wrote the article “Do Lifestyle Funds Provide Greater Security” some 4 years ago, just before the U.S. bear market was running out of steam.

You can read it at: http://www.successful-investment.com/articles11.htm

Whether you decide to use Lifestyle Funds, or any other vehicle for that matter, using a prudent approach by staying out of the bear trap (via a sell stop discipline) will do more for your financial health and your future retirement than the investment itself.