The markets corrected in a big way today with all major indexes closing sharply to the downside. It was one of those days, where you could not find a place to hide.

While you can read about what happened in any newspaper or on your favorite financial web site, I want to briefly talk about how this drop affected our trend tracking methodology.

The answer is “not at all.”

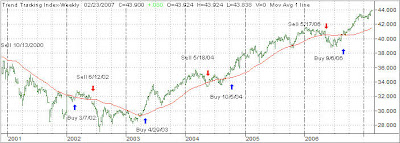

Here’s how the day played out as far as our Trend Tracking Indexes (TTIs) is concerned:

TTI for domestic funds dropped from +5.79% (on 2/26/27) to +3.99% today.

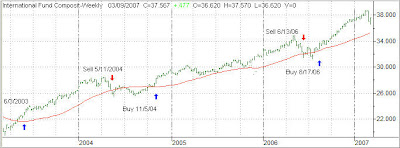

TTI for international funds dropped from +10.25% (on 2/26/07) to +6.90% today.

In other words, the long-term uptrend is still alive as of right now, and we need to monitor to see what develops in the next few days.

What about our sell stops? As you know, for domestic and international funds we use a sell stop point of -7% off a fund’s high. None of our holdings have hit this point today and many have dropped off their highs by only -2.5% on average. That means no change in our holdings.

How about sector and country funds? In that arena, we use sell stops of 10% and none of our positions have violated that point either.

Bottom line is that this day of a market meltdown, while certainly reducing some of our unrealized gains, has not had an impact on our invested positions.

One day events usually don’t make a trend. This is not to say that this could not be the beginning of a long-term reversal, but it’s too early to tell. As long as you have a plan in place, as I have been writing about for a long time, you should not make panic decisions based on today’s activity. If some of your stop loss points got hit, by all means, take action. If they haven’t, keep monitoring the activity and let the markets tell you when it’s time to exit.

Trying to keep your emotions out of the decision making process on days like this is the key to becoming a successful long-term investor.