- Moving the markets

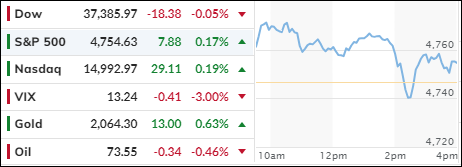

The stock market kept up its momentum from last week and kicked off the final week of the year with a bang. The S&P 500 edged closer to its all-time high, as investors shrugged off the holiday blues and low trading volume.

The upbeat mood was fueled by signs of easing inflation, which is getting closer to the Fed’s 2% goal. This also raised hopes of interest rate cuts in 2020, which would be music to the ears of many traders. Some are calling this a “goldilocks” scenario, where everything is just right: low inflation, steady growth, and no more rate hikes.

The optimism was supported by some solid economic data, including rising home prices, a strong National Activity index, and a positive Fed Manufacturing index. These indicators helped lift the US Surprise index, which measures how the economy is performing relative to expectations.

The bulls also got a boost from some short squeezes, which forced bearish traders to cover their bets and push up the prices of some of the most hated stocks. The tech sector also saw some action, as some of the most unprofitable companies soared to new heights. Here’s a chart from ZeroHedge that shows the madness.

The bond market was relatively calm, with yields staying flat for the day. The 2-year yield had some wild swings, though, as the dollar weakened, and gold regained its shine above $2,070. Oil prices also jumped back above $75, as supply concerns outweighed demand worries.

The only sour note in the economic data was a drop in consumer confidence, which contrasted with a rise in personal spending. Apparently, Americans are racking up $1 trillion in credit card debt to buy things they don’t really need or want or, are they in survival mode?

How long can this go on?

Read More