MarketWatch reports that “Bear Market brings new funds for the fearful:”

MarketWatch reports that “Bear Market brings new funds for the fearful:”

After last year’s market meltdown savaged just about every U.S. and international asset class, many investors have concluded that traditional portfolio diversification is not only discredited, but pure bunk.

In an appeal to these skeptics, some mutual-fund firms have introduced products they claim provide greater protection in bear markets than traditional balanced funds that blend stocks and bonds.

Firms say that investors can find comfort in these new funds, knowing that losses will be minimized and risk-awareness increased. But critics point to the higher fees and lack of a track record for some of these portfolios, and question the need to tinker with established investing formulas.

“I’m quite skeptical of any fund that says you can have your cake and eat it, too,” said Leo Marzen, partner at New York-based wealth manager Bridgewater Advisors Inc.

Among the new-style mutual funds launched this year are so-called absolute-return funds from Putnam Investments, and the AIM Balanced-Risk Allocation Fund, an asset allocation fund from Invesco Ltd. that invests according to risk-management techniques.

Absolute return is a strategy that shoots for positive returns regardless of market conditions. The problem, say critics, is twofold: There’s not much wrong with mainstream investing strategies that a tweaking of asset allocations can’t fix, and 2008 was such a bad year that everything suffered.

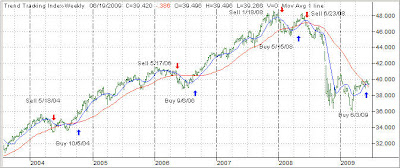

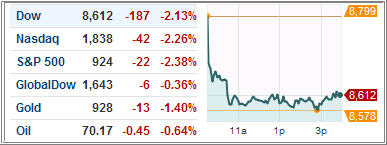

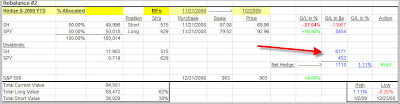

“A lot of this is just a reminder that really nothing worked last year,” said John Coumarianos, a mutual-fund analyst at investment researcher Morningstar Inc. “Treasuries were the only thing that held up.” Read the highlighted part again. The ignorance and cluelessness is absolutely mindboggling. To state that “there is not much wrong with mainstream investing strategies that a tweaking of asset allocation can’t fix” has to go down as the most stupid statement of the year. I would like to see a sample of that tweaked asset allocation. Tweaking it how? By adding a different menu of bullish funds and hoping they will fare better during the next bear market? Yes, everything asset class suffered in 2008. Moving to the sidelines, and staying in cash, was the only way to survive the bear. But that is something you will never hear in the mainstream media and certainly not from Morningstar. Be very aware of the pitfalls when you read articles like this one and look at the “new funds” with a grain of salt. Chances are that this is just another attempt to keep people investing when common sense (and Trend Tracking) tells you, you should be out of the market altogether.

[My emphasis]