A few days ago, Mish at Global Economics wrote a nice piece called “Long Term Buy and Hold Is Still Bad Advice.” I want to hone in on a few paragraphs outlining well known pitfalls when investing that are very important; however, most investors are either not aware of them or don’t pay attention:

A few days ago, Mish at Global Economics wrote a nice piece called “Long Term Buy and Hold Is Still Bad Advice.” I want to hone in on a few paragraphs outlining well known pitfalls when investing that are very important; however, most investors are either not aware of them or don’t pay attention:

Why Is Bad Advice So Common?

Clearly, stay the course is bad advice. So why is it so common? A personal anecdote might help explain things: In January of this year, an investment advisor from Wachovia Securities called me up and stated “Mish, I am sitting on millions because I see nothing I like”. I told the person I did not like much either and that Sitka Pacific was heavily in cash and or hedged. His response was “Well, I do not get paid anything if my clients are sitting in cash”.

I called up a rep at Merrill Lynch and he said the same thing, that reps for Merrill Lynch do not get paid if their clients are sitting in cash.

Massive Conflict of Interest

Notice the massive conflict of interest possibilities. Reps for various broker dealers have a vested interest in keeping clients 100% invested 100% of the time, even if they know it is wrong. And so it is every recession, bad advice permeates the airwaves and internet “Stay The Course”.

There you have it. Nothing has changed since the last bear market in 2001 as I wrote back then in “The Conflict of Interest Game,” “The Demise of Buy and Hold” and “Your Worst Enemy to Successful Investing.” These articles are 8 years old, and I am sorry to say they are just as true nowadays as they were back then.

A Look Ahead

Clearly stocks are a better buy now than in 2007 or 2008. But that does not mean stocks are cheap. Indeed, by any realistic measure of earnings, stocks are decidedly not cheap. Then again, 6-month treasury yields are yielding a paltry .31%.

Can equities easily beat that? Yes they might, but that does not mean they will! Fundamentally, the S&P; 500 can easily fall to 500 or below, a massive crash from this point. Alternatively, stocks might languish for years.

…

The Japanese Stock Market is about 25% of what it was close to 20 years ago! Yes, I know, the US is not Japan, that deflation can’t happen here, etc, etc. Of course deflation did happen here, so the question now is how long it lasts. Even if it does not last long, there are no guarantees the stock market stages a significant recovery.

Buy and hold is no more likely to be a good choice for the next 5 years than it was for the last 20.

Yes, no one knows how the next few years will play out, but a similar scenario, as Japan has experienced, is a distinct possibility.

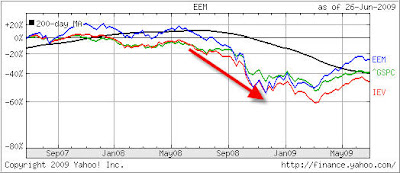

From this point forward, we may see rally attempts followed by sharp drops into bear market territory or vice versa. So far, this century has not been kind to the buy-and-hold crowd with the S&P; 500 being down 37% since 12/31/1999.

I believe that there are several steps you can take to guard against the unknown:

1. Never ever listen to anyone with a biased opinion, such as a commissioned sales person. The closest you can get to receiving unbiased advice is from a fee only advisor.

2. Never take any investment advice from the media.

3. Follow the trends in the market place and be disciplined by establishing an exit point at the time you make your initial investment.

4. Take a little time to explore my SimpleHedge Strategy. I believe it has great potential to successfully deal with the uncertain market conditions we will be facing over the next few years by greatly reducing market risk while offering good profit potential.

This week so far has been a little roller coaster with an up day followed by a down day, which was followed by an up day.

This week so far has been a little roller coaster with an up day followed by a down day, which was followed by an up day.