In regards to my recent post “7 Years Of Wealth Wiped Out,” reader VR had this comment:

It’s almost funny when I try to talk people out of buy-and-hold strategy and point them to your blog for market-timing.

Everyone is afraid of missing out on a big rally. They don’t really mind losing more than 50% of their investment to a bear.

The worst is that no one believes that the market could go further down from this level.

It’s hard for me to believe that anyone would be more concerned about missing out on a rally than protecting himself from downside losses. I suppose that old habits die hard because the buy and hold proponents have done a great job of brainwashing the public for a long time.

However, numerical facts, which most don’t bother to look at, show a different picture. You most certainly remember the last bear market of 2000, the brunt of which we avoided by selling on 10/13/2000. On that date, the S&P; 500 stood at 1,374. Two days ago, it closed at 779, which is a loss of about 43% over some 8-1/2 years.

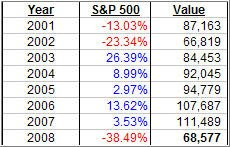

Since most investors and professionals alike are desperately trying to beat the S&P; 500 performance, and most fail to do so, many portfolios have done worse. Looking at it another way, year over year, this century has not been kind to the buy-and-hold investor as the following chart shows: This means a portfolio with a starting value of $100,000 would now be worth $68,000. 8 years of investing via buying and holding and nothing but losses to show for.

This means a portfolio with a starting value of $100,000 would now be worth $68,000. 8 years of investing via buying and holding and nothing but losses to show for.

If the markets don’t provide us with a significant rally over the next couple of years, many investors will become acquainted with our own version of the “lost decade.”

Since bear markets are a fact of life, and can strike at anytime, a smart investor needs to recognize that fact by using some sort of an exit strategy. This century has shown that selling at the right time is far more important than when and what you buy.

Not selling can have a devastating effect on your portfolio, as we’ve seen, while missing out on the initial stages of a bull market will merely reduce your potential profits.