The prospect of inflation, along with the destruction of the dollar, seems to be on many readers’ minds. Frank’s question is very typical:

I have been reading your newsletter for over 2 years, and I enjoy your comments. I have one question and it is a big one do you think we are really heading into deflation or will inflation finally kick in?

While I am not an economist, I have some thoughts on the topic. Keep in mind that after the greatest real estate/credit bust the world has ever seen we have moved into unchartered territory.

To me that simply means that any sudden government or Fed action/intervention can have unintended consequences that can change previous assumptions. Case in point is the recent implementation of QE-2 (Quantitative Easing) in early November designed to stimulate the economy and keep interest rates low. Well, that did not work out too well as interest rates have been on a rising trajectory.

Given the current environment, I see more deflationary forces than inflationary ones. This does not mean it might not change in the future, especially with the Fed being hell-bent on producing inflation.

If I look around, I see nothing but red numbers on every level of government. Many states, cities and municipalities are not able to fulfill their obligations including pension plan promises; more layoffs are virtually a guarantee. I expect a host of cities to default and/or go through bankruptcy proceedings in order to reorganize with the purpose of reducing debt and obligations.

Looking over to Europe, the situation looks equally dire, if not worse, with debt problems being the center point of endless government meetings. All of these issues are deflationary in nature.

To be clear, if you follow sound Austrian economic principles, inflation is defined as the expansion of money supply and credit, with deflation being the opposite. Most readers, however, only look at price levels to define these terms. That’s incorrect, as prices are the effect and not the cause.

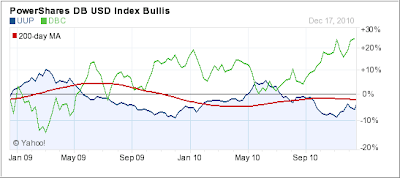

Talking about prices, there is an interesting play between the dollar and commodities. Most days, they move in opposite direction, as a weaker dollar is considered inflationary. Take a look at the following 2-year chart:

It shows the bullish dollar (UUP) compared to the commodity index (DBC). Their opposite price movements are clearly demonstrated. So, if you are worried about a declining dollar, DBC should be a part of your portfolio.

As I have posted before, the dollar has been the favorite whipping boy of the world for quite some. However, as soon as a crisis develops somewhere, everybody wants to own the dollar—don’t write it off yet.

Some economies are clearly overheating and are experiencing their own not yet admitted real estate/credit bubble. China, Canada and Australia come to mind. They are facing economic circumstances somewhat similar to what we witnessed around 2007. While inflation is an issue in these countries, it may not be once the bubbles burst.

At this time, I see no inflation on the horizon here in the U.S. I believe that we are following the footsteps of Japan, as we are attempting to solve our debt issue in the same manner that they did (stimulus attempts, creation of zombie banks, etc). Nothing was learned from the fact that stimulus programs don’t work in the long run and Japan, 20 years after their real state bust, has clearly proven that.

Disclosure: Holdings in DBC