In case you missed it, Al Thomas, author of the well known book “If It Doesn’t Go Up, Don’t Buy It!” posted another right-on-the-money article last week titled “Watch The Market Dive:”

In case you missed it, Al Thomas, author of the well known book “If It Doesn’t Go Up, Don’t Buy It!” posted another right-on-the-money article last week titled “Watch The Market Dive:”

The form is predictable. The execution is slightly different.

That is the difference in a belly whopper and a 10 at the Olympics.

Each participant slowly climbs the ladder to the height that has been chosen. She then walks along the level area of the board to the end and grips the board with her toes, bends her knees and with a final spring to a high point her body dives to a final splash.

This is the same form for our stock market. Watch closely. Since March investors have slowly climbed its ladder (Called a ‘Wall of Worry’) and the market has now leveled off. It has reached the end of the level price range and is now ready to make its final spring before that fatal plunge into the depths.

Our market mavens have turned from swimmers into gardeners. The early seeds of March have sprouted into “green shoots”. Any bit of bad news that is not as bad as the previous news it greeted with sprinkling of fertilizer, shouts of joy and some buying. Some, not all, are willing to take a chance at this level. Lack of buying will allow the market to fall of its own weight. There is not enough fertilizer.

Any professional trader with 10 or 15 years of experience will tell the novices that he has never seen a “V” bottom that continued up. There always has to be a test. The market must come back to prove its strength by not making a new low. This is the famous “W” formation the institutional investors are waiting for.

The next market weakness must prove itself by not making a new low on the coming setback. Then professional traders will put the market up.

Historically in 1929 everyone remembers the horrendous bear market, but no one remembers that big rally in 1930.It was this subsequent decline that did more damage than the first decline. Will that happen again? That is the 64 Trillion dollar question.

Based on the actions of Washington politicians the most likely correct guess would be ‘yes’. Huge unbridled and increasing debt and trillions in entitlement programs can only stagnate the U.S. economy. Washington is following the same road as Japan which is now in its 17 year of recession.

Politicians find it easier to get elected by promising more “free stuff” than being financial responsible. As they get elected they shift the solution (if there is one) to the next generation. Our children and their kids will be paying these bills.

Maybe the whole world will declare bankruptcy and everyone can start over. And pigs can fly.

Our diver is approaching the end of the board. The final spring is about to be sprung. Investors are about to plunge in over their heads again. Many will drown.

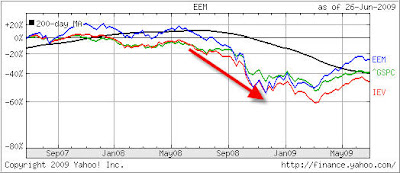

I have to agree with this assessment and can only recommend that those investors, who were blindsided by last year’s market debacle, better be prepared (via a sell stop discipline) to deal with the possibility of another downdraft. I am not being negative here, but simply realistic in looking at where we are, economically speaking, and were we might be going.

We’ve rebounded off the bottom but only barely into bullish territory. There is no assurance anywhere that this trend will continue; on the contrary, with the question abounding about the reality of a second half recovery, we could see a trend reversal in no time at all.

If you have not read Al’s book, I suggest you do so. Yours truly, along with Trend Tracking, is honorably mentioned.