Emerging markets, the leader of the past, have been holding up relatively well since the Egyptian crisis has erupted as MarketWatch reports:

For emerging markets investors, the unrest in Egypt has been unsettling, to say the least. But the steep losses in Egypt’s now-shuttered stock market barely have affected the returns of emerging-markets mutual funds and exchange-traded funds.

The Egypt market’s 21% slide year-to-date is painful, but Egypt represents about 0.38% of the MSCI Emerging Markets Index (Egypt is not a so-called frontier market, according to MSCI). The emerging-market benchmark is down about 1.4% so far this year. What is Egypt’s contribution to that loss? About eight basis points, or 0.08%.

Of course, the political storm engulfing Egypt is taking aim at other countries in the Middle East and Africa, so fund and ETF investors may be in for more shocks. But this is the price of risk that emerging-markets investors pay in exchange for the promise of extraordinary returns. Only now that risk is extraordinarily high.

Sure, while the effect of the Egyptian uprising has been limited in scope so far, there seems to have been some directional change in the emerging markets since the beginning of this year, which happened even before Egypt entered the picture.

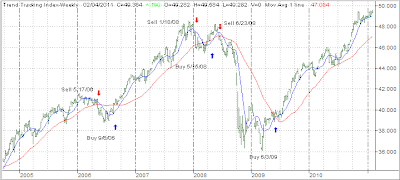

Here’s a 6 months chart showing the S&P; 500 vs. the emerging markets ETF (VWO):

As you can see, since the Fed’s Quantitative Easing initiative (QE-2), which was enacted the beginning of November, VWO has been very volatile and seem to have disconnected from the domestic market, as represented by SPY, since January 2011.

You could argue that this was one of those unintended consequences of QE-2 as was the rise in interest rates. While the S&P; 500 has been on a straight upward path, VWO has headed south and has come off its high by -4.58% as of 2/3/11.

It’s too early to tell whether the major trend of the emerging markets has indeed come to an end, but you should be prepared to exit in case things get worse. Remember, for country funds/ETFs, I recommend the use of a 10% trailing sell stop.

I have written about known and unknown uncertainties. Egypt was definitely an unknown and unexpected one with more fallout potential from other surrounding countries a real possibility.

It appears that the world we are living in grows more uncertain by the day, which eventually will affect the domestic stock market as well. Although right now it seems that things are a lot worse elsewhere than here in the U.S., so we may have some more upside potential.

However, when directional changes occur, they may happen fast and furious, if they are triggered by a major adverse event. Don’t become complacent; always be prepared to exit and establish your strategy now, and not when the market heat is on.

Disclosure: Positions in VWO