Hat tip goes to Mish at Global Economic Trends for pointing to a link featuring an interview with the author of the well known book “The Black Swan” Nassim Taleb.

Hat tip goes to Mish at Global Economic Trends for pointing to a link featuring an interview with the author of the well known book “The Black Swan” Nassim Taleb.

I reviewed his books sometime last year and being a being a very straight thinker, he had some interesting thoughts in a recent interview on the current state of the economy.

Here are some highlights:

Margaret Wente: Happy days are here again. The central bankers say the recession is over. The markets are buoyant. Can we relax?

Nassim Taleb: Not at all. Central bankers have no clue. In the first place, the financial crisis was not a black swan. It was perfectly predictable. They ignored the phenomenal buildup in leverage since 1980. They acted like airline pilots who’d never heard of hurricanes.

After finishing The Black Swan, I realized there was a cancer. The cancer was a huge buildup of risk-taking based on the lack of understanding of reality. The second problem is the hidden risk with new financial products. And the third is the interdependence among financial institutions.

MW: But aren’t those the very problems we’re supposed to be fixing?

MT: They’re all still here. Today we still have the same amount of debt, but it belongs to governments. Normally debt would get destroyed and turn to air. Debt is a mistake between lender and borrower, and both should suffer. But the government is socializing all these losses by transforming them into liabilities for your children and grandchildren and great-grandchildren. What is the effect? The doctor has shown up and relieved the patient’s symptoms – and transformed the tumor into a metastatic tumor. We still have the same disease. We still have too much debt, too many big banks, too much state sponsorship of risk-taking. And now we have six million more Americans who are unemployed – a lot more than that if you count hidden unemployment.

MW: Are you saying the U.S. shouldn’t have done all those bailouts? What was the alternative?

NT: Blood, sweat and tears. A lot of the growth of the past few years was fake growth from debt. So swallow the losses, be dignified and move on. Suck it up. I gather you’re not too impressed with the folks in Washington who are handling this crisis.

Ben Bernanke saved nothing! He shouldn’t be allowed in Washington. He’s like a doctor who misses the metastatic tumor and says the patient is doing very well. The first thing I would tell Chinese officials is, how can you buy U.S. bonds as long as Larry Summers is there? He’s a textbook case of overconfidence. Look what happened to Harvard’s finances. They took a lot of risk they didn’t understand, and it was a disaster. That’s the Larry Summers mentality.

…

MW: You also say that competition among big companies is the Achilles heel of capitalism. What do you mean by that?

NT: If you make corporations compete, sometimes the one that appears most fit for survival is really the one that is most exposed to the negative black swan. What happens is that if you make $4 a share but you’re betting the ranch, like GE, the analysts will love you. But if you make only $2 a share with no risk on your book, they’ll say you’re not doing well. All the incentives are perverse.

…

MW: So if everyone is still on the wrong track, what’s the right track?

NT: My whole idea is to lower risk in society by developing a system that can resist human error, rather than one where human error rules. The first step is to make sure that no financial institution is too big to fail. Next, make sure governments don’t favor big companies. Governments should also decrease the role of economists – they’re no more reliable than astrologers, and they do more damage.

Nassim has been warning about unpredictable events for a decade and has foreseen the credit crunch. I happen to agree with his assessment, although he is far more qualified to talk about these issues than I am.

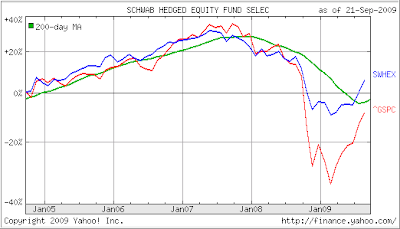

We will continue to have to live with great uncertainty. While we have no control or influence over what governments can and will do, we at least can improve our odds of not going down should the markets finally recognize that this recent rally was based on nothing but smoke and mirrors.

Having an exit strategy for “all of your positions” will ensure that any losses will be minimized so that your portfolio can be safely on the sidelines, should a “Black Swan” event occur.

Yesterday turned into one of those classic “buy the rumor, sell the fact” situations as the Fed’s unchanged stance on interest rates failed to inspire the buyers.

Yesterday turned into one of those classic “buy the rumor, sell the fact” situations as the Fed’s unchanged stance on interest rates failed to inspire the buyers.