Due to my travels to Germany, there will be no post today. I expect to be back on line by Tuesday.

Sunday Musings: Portfolio Anxiety

Just about every week, I receive reader requests to comment on their current portfolio holdings. The latest came from Martin, who had this to say:

Just about every week, I receive reader requests to comment on their current portfolio holdings. The latest came from Martin, who had this to say:

I would be appreciative if you could make any recommendations or comments on my portfolio, as follows: I am a retiree with these vanguard funds: International growth-5%, Primecap core-21%, small cap growth-5%, wellington-3%, mid-growth-2%, small cap growth-7%, Inflation protected-7%, star fund-3%, healthcare-3%, intermediate investment grade-3%, convertible bond fund-4%, intermediate bondfund-2%. I also own Tiaa-Cref: tiqrx-3%, tiilx-8%, tibdx-3% and the balance in cash and individual bonds.

Your reply would be much appreciated as to whether these funds are suitable for a 70 year old, any that should be replaced or exchanged, etc.

While I can’t give specific advice without knowing more details about Martin, I can make some general observations.

To me, it would be interesting to know if you owned this portfolio last year and held on to it through the market crash. If so, you would know that just about all of your holdings declined sharply causing you severe portfolio anxiety.

If you set up this portfolio earlier this year, then you are sitting on some nice unrealized gains. The question in my mind simply is as to whether you are planning on holding this portfolio or if you are using an exit strategy to get out of those positions that decline with the next market pullback.

There is nothing wrong with your selection of funds if your mode of operation is to follow the trends until they end and then let your sell stops be your guide as to when to exit.

On the other hand, if you are asking me if this is a well diversified portfolio to hold onto no matter what, then my answer will be no. Last year has clearly shown that a portfolio, no matter how diversified, will go down in a bear market scenario.

Don’t participate when the next down leg starts, which it will; I am just not sure of the timing. At 70 years old, you can’t afford to take the incredible risk that buy-and-hold investing exposes you to.

Sell Stops For Hedges

Reader comments are an important component of my daily blog posts. They add valuable information to the topic discussed and many times lead to more posts on related issues.

Some readers prefer to comment anonymously, which I don’t have a problem with unless this privilege is abused. This happened a few days ago when one reader addressed an issue in a way that should have been emailed to me directly for clarification. Naturally, his comment did not get published; however, he brought up a valid point, which I want to address today.

The issue most discussed over the past couple of weeks was the use of sell stops for ETFs, mutual funds and bond funds. But how about hedges? How are sell stops applied there?

Let’s review again the purpose of the hedge:

It allows us to safely establish a position “prior” to our domestic TTI signaling a Buy.

After the markets made their lows the beginning of March 09, we were able to set up a hedge during March even though our domestic TTI did not signal a Buy until June 3, 2009.

Let’s see how this hedge actually played out over the past few months and where the sell stop should be placed. Take a look at this tracking matrix for this particular hedge, which was set up for a number of clients:

[Double click to enlarge]

As you can see, during this bullish run, the short position lost 28.14%, but the long positions gained more resulting in an unrealized gain of 6.72%. The 7% sell stop will be implemented on the result of the entire hedge and not on the performance of its components.

In other words, the high gain made on 9/16/09 was +6.75% and the 7% sell stop loss will be calculated off that high number.

While this hedge averaged about 1% per month, this certainly pales in comparison with the S&P;’s +30.89%. On the other hand, the S&P;’s numbers are more of a statistical measure than anything else, because most investors certainly did not get into the market with a meaningful portion of their portfolios back in March.

As the markets confirmed their bullish trend, I dropped many (not all) of the short components for clients’ accounts in order to become net long and add to the positions. That choice strictly depended on the risk profile of the individual client.

Remember, this hedge concept may not be for you, but there are many investors who have had either very bad buy-and-hold experiences and/or are retired and prefer less of a roller coaster way of investing their monies.

I have always maintained that the comfort level an investor has with an investment methodology is far more important than the investment itself.

No Load Fund/ETF Tracker updated through 10/8/2009

My latest No Load Fund/ETF Tracker has been posted at:

http://www.successful-investment.com/newsletter-archive.php

The major indexes recouped two weeks of losses as the Bull run continued.

Our Trend Tracking Index (TTI) for domestic funds/ETFs has now crossed its trend line (red) to the upside by +8.81% keeping the current buy signal intact. The effective date was June 3, 2009.

The international index has now broken above its long-term trend line by +15.28%. A Buy signal was triggered effective May 11, 2009. We are holding our positions subject to a trailing stop loss.

[Click on charts to enlarge]

For more details, and the latest market commentary, as well as the updated No load Fund/ETF StatSheet, please see the above link.

Exiting The Market: Sell Stop Vs. Trend Line Break

Reader Tom had the following question in regards to exiting the market:

Reader Tom had the following question in regards to exiting the market:

I had some time to kill so I did a spread sheet on my brokerage results and found something interesting that raised a question.

Assuming the TTI tells us to hold, but we have a trailing 7 percent Stop Loss set…..would we be better off holding until the TTI signals a sell…or letting the Stop Loss get us out BEFORE the TTI indicates is time to bail out?

If you look at the spread sheet you can see that the July positions I was in stopped out but the TTI said “hold”….I would have been better off ignoring the Stop as you can see from today’s price points on the ETFs that were sold.

That’s a very good question. The reason for the trailing sell stop is that the TTI can move substantially above its long term trend line. Right now, it is positioned 9.07% above it. The TTI by nature is a slow moving indicator whether the market is rallying or retreating.

If you were to wait until the TTI breaks through its long-term trend line on the way down, you would give up too much profit until the sell signal kicks in. Even worse, by waiting that long, you could possibly turn a winning position into a losing one.

The alternative to avoiding that scenario is the use of the trailing sell stop. It will from time to time, as you have experienced, give you a whip-saw signal, which will cause you to have to find a new entry point if the markets head back up.

There is no way that this can be avoided (unless you buy and hold), so look at whip-saws as simply insurance, which will protect your portfolio from possible market disaster.

Making Up Losses

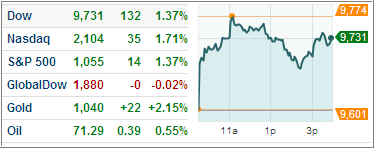

The markets rallied for 2 straight days and made up the losses of the entire last week, which puts us now back within striking distance of the psychological Dow 10,000 barrier.

Gold hit a record yesterday as the dollar weakened. The widely held GLD gained 2.46% on the day. As I posted about last week, we are participating in the metals and some currencies in a more conservative fashion via PRPFX, which gained a more modest 1.09% but is up over 9% since we bought it in early June.

Some mutual funds/ETFs are simply better suited for trend tracking than others. They tend to have less erratic swings by moving somewhat slower to the upside, but they also don’t crash to the downside. These slower moves avoid whip-saws and let us stay aboard a lot longer than we would with more volatile funds/ETFs.

A good way to avoid fast moving ETFs and mutual funds is to drop down the M-Index rankings when analyzing the weekly StatSheet. If you are an aggressive investor, you can consider selecting some of the top ranked ETFs, but be aware that frequent whip-saws, whenever the markets correct, will be part of your investing life.

If you are more conservative, go further down the list and, while your upside will be more limited, so will be your downside. As I said before, it all depends on your individual risk tolerance.