Reader Vik has this viewpoint regarding the use of sell stops:

Reader Vik has this viewpoint regarding the use of sell stops:

Thanks for all your work. I have expressed my views earlier but I will just repeat them. Trend tracking is excellent method of investing particularly when investing is not your primary job function.

Having said that, I feel that you don’t follow your own method. It would work much better to follow the long term trend instead of the stop loss at 7%.

According to your charts, the long term trend hardly reverses more than once a year. But during the same time, there are several 7% or more dips. I have three issues with trading on that:

1) You have to babysit it every day

2) You lose money on every 7% dip

3) You transact too many times which prohibits investing in some funds.

You have already said that your clients would not like their profits vanish if you went purely by trends instead of 7% dip rule. I think this is more of educating them by historical examples of which method ultimately works better.

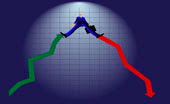

Over the past 20 some years, there have been quite a number of market pullbacks that would have turned a major profit into a loss (a cardinal sin of investing), had it not been for the use of trailing sell stops. During the roaring 90s, there was no reason to use anything but the trend lines as exit points, as the bull market was in full swing.

As we entered the first bust in 2000, the name of the game seemed to have changed, which made the use of a sell stop discipline an absolute must. In 2008, you could have gotten away with only using the trend lines as an exit point, but that is with the benefit of hindsight.

It’s a matter of simple math. Trend lines, such as used with my TTIs (Trend Tracking Indexes), move slowly and therefore have a lagging effect, which can endanger your unrealized gains, especially after severe market activity.

To demonstrate the lag, take a look at 2008 again. After we sold out on 6/23/08, the market corrected so violently to the downside that even after the low was reached on 3/9/09, we did not get a buy signal until 6/3/09.

Now let’s look at the current status of the domestic TTI. It is positioned +4.87% above its long term trend line. If the market heads down from here, your 7% sell stop will bail you out way before the TTI crosses its trend line to the downside, therefore locking in a higher profit.

Of course, if this were to turn into a whip-saw, we’d be looking for a new entry points as discussed in previous posts.

Regarding the above three issue you have with trend tracking:

1. Given how much time most people waste on useless endeavors, like watching TV, spending 5 minutes a day updating stop loss points seems hardly a task at all. I have found that most investors have way too many holdings, which makes updating sell stops more of a chore. For a million dollar portfolio, you should be in no more than 10-12 funds/ETFs.

2. Sometimes you do, but more often than not, you end up being stopped out at a profit as I posted in “Buy-In Vulnerability.”

3. Sure, trading restrictions are an issue we all have to deal with most of the time. Fortunately, ETFs have become the main player, which has solved this problem for many. I have some clients with Fidelity 401k funds, which we purchased at the last buy signal on 6/3/2009, and we have not been stopped out yet despite several pullbacks. I attribute this to a more conservative selection process, which you should use when dealing within a restricted playing field.

What it comes down to is for you to use the approach that you are most comfortable with, and that matches your day-to-day schedule best. I for one prefer the use of trailing sell stops as my exit points, but that does not mean you have to as well.