Reader Joe had an interesting comment in response to Saturday’s post “Beating the S&P; 500 Index with an S&P; 500 Mutual Fund.”

Here’s what he had to say:

There is a flaw in your hedge – all Ultra-Long and Inverse funds have a “daily rebalancing” problem that causes them to all trend down over long periods.

For example, if you bought SPY in early November and sold it yesterday, you broke even. However, if you held SH for the exact same period, you would have lost 10% of your money. See the charts attached.

You are better off shorting SPY as a hedge (or even better, shorting 1/2 as much of SSO since it has the same problem, but by going short you put it to your advantage – the trouble is finding shares to short, and also you can’t short in a retirement account).

I appreciate Joe’s input since it allowed me to look at other hedge scenarios I normally would not have considered. I do not advocate hedging SH vs. SPY, but since he brought it up, I decided to run the test.

As an aside, whether inverse funds do daily rebalancing or not, does not matter to me; what matters is the published closing price, which is what I work with and which is the standard used to mark all accounts to market.

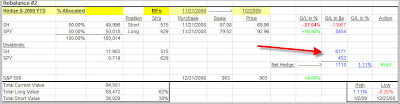

There are a few things that you may have overlooked when doing your calculations. First, SH had a huge distribution in December 08, which you must have not have considered. Here’s what the matrix looks like for that time frame:

[Click on chart to enlarge]

Please note, the distribution had a major effect on the outcome during this period and is most likely not accounted for in the charts you presented.

Second, the key is the rebalancing of the hedge when it becomes lopsided. Any hedge has an optimum rebalancing percentage, but for this example, I have used 61%.

Here’s the summary for testing your hedge SH vs. SPY for the period of 11/3/08 to 6/12/09:

[Click on chart to enlarge]

As you can see, this turned out to be a winning situation and not at all what you had assumed. It’s a better outcome than what I would have expected from such a hedge combination.

Comments 6

Ulli,

Have any of your simulations or actual portfolios had the condition where the entire hedge fell 7% or more and needed to sell all hedged funds?

StarBright,

Very rarely; but is has happened.

Ulli…

Starbright,

Usually, the hedge was up first by 3-4% before a sell kicked in. That means portfolio risk was reduced by that amount since the sell stop is trailing.

Ulli…

OK. Thanks very much.

Ulli, is it true that you can't short in a Retirement Account?

Raledo,

You can't sell stocks short, but you can buy indexes such as SH that will generate a short position.

Ulli…