- Moving the market

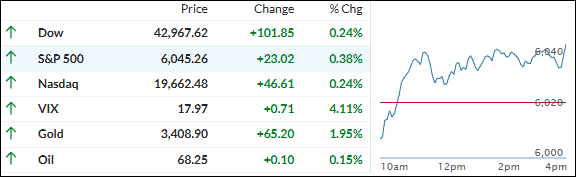

Stocks started the day in the red but quickly turned things around, climbing out of the early dip and finishing solidly in the green. The major indexes all pushed above their breakeven lines, riding a wave of renewed optimism.

Fueling that positive vibe was the May Producer Price Index (PPI), which came in cooler than expected—up just 0.1% after a 0.2% drop in April. Economists were bracing for a 0.2% rise, so this softer number gave investors a bit of relief on the inflation front.

Still, Wall Street isn’t breathing easy just yet. Trade tensions between the U.S. and China remain front and center. President Trump hinted at flexibility on the July 8 deadline for new tariffs, not just with China but with other trading partners too. That’s keeping markets on edge.

Looking ahead, the big question is whether we’ll see a breakthrough on tariffs. A resolution could be the spark that sends markets to new highs—especially if it aligns with budget talks and the Fed’s next move. Without it, we might just drift sideways in a fog of uncertainty.

Adding to the mixed signals, Trump said the U.S. is “fairly close” to a deal with Iran—then followed it up with a cryptic comment about “something possibly happening soon in the Middle East.” Not exactly reassuring.

Despite all that, the Dow and S&P 500 managed to close at their intraday highs. The 10-year Treasury yield hit session lows, and Bitcoin also dipped—though without any clear reason.

Meanwhile, precious metals had a strong day, with gold bouncing back from recent losses and silver rebounding after slipping below $36.

With geopolitical tensions simmering, especially in the Middle East, could gold and silver be the safe havens investors turn to next?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

After a shaky start, the major indexes found their footing and finished the day with modest gains. Gold stole the spotlight, jumping 1.89% to lead the pack.

Our TTIs followed suit, pushing further into bullish territory and reinforcing the positive momentum.

This is how we closed 06/12/2025:

Domestic TTI: +2.02% above its M/A (prior close +1.78%)—Buy signal effective 5/20/25.

International TTI: +7.72% above its M/A (prior close +7.36%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli