- Moving the markets

While the headlines were screaming “Fed fires off biggest interest-rate hike since 2000,” the reality of it is that the increase in the Fed Funds rate from 0.5% t0 1% is hardly enough to fight inflation with a current CPI of 8.5%, which likely will explode higher next week with the latest data release.

For the moment, however, the big news was that the Fed hiked in line with market expectations, which catapulted the indexes sharply higher and wiped-out last Friday’s losses. It also shows that the Fed is beholden to the markets, which by many has been considered a policy error, as they hung on way too long to the “inflation is transitory” theme and ignored the magnitude of the growing inflationary forces.

Be that as it may, for today, a bear market relief rally finally gave the bulls some hope, as the opinion that the Fed can slow inflation without causing a recession prevailed. Just because Fed head Powell placated markets today does not mean he won’t turn more hawkish once the inflation numbers worsen.

For today, that thought was not on deck, as Powell explained:

“So a 75 basis point increase is not something that committee is actively considering, I think expectations are that we’ll start to see inflation, you know, flattening out.”

“I would say we have a good chance to have a soft, or soft-ish, landing.”

Really? I think the Fed chair will eat these words in the future but, at this moment in time, that was all it took to shift the computer algos into overdrive, and up went.

Since the bullish theme overrode all common sense, ZeroHedge tried to instill some reality with this tweet:

Bond yields jumped initially, with the 10-year touching its 3% level twice before backing off on Powell’s statements.

All sectors joined the rebound, but energy, VDE, took top billing with a gain of +4.13%, while commodities (DBC) performed very well by adding +3.12%. Gold lagged but managed to rally +0.98% but could not climb above its $1,900 level.

Of course, no rally can happen without a short squeeze, and today was no exception. Crude Oil soared, the dollar tumbled, while the Russian Ruble rallied to it strongest relative to the dollar since February 2020, as ZH pointed out.

Then Powell ended with this:

“Our tools don’t really work on supply shocks, our tools work on demand.”

Makes me go “hmm.”

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

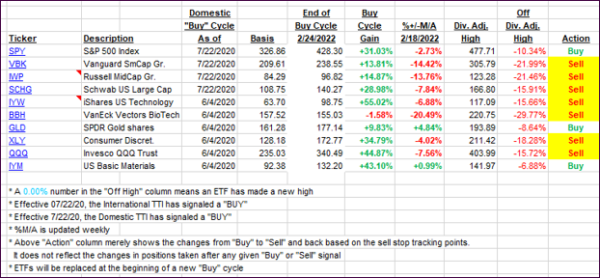

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this just closed-out domestic “Buy” cycle, here’s how some of our candidates have fared:

Click image to enlarge.

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -12% point has been taken out in the “Off High” column, which has replaced the prior -8% to -10% limits.

3. Trend Tracking Indexes (TTIs)

Our TTIs jumped, but remain in bear market territory, as Powell’s dovish rate hike stoked the bulls.

This is how we closed 05/04/2022:

Domestic TTI: -1.25% below its M/A (prior close -3.92%)—Sell signal effective 02/24/2022.

International TTI: -3.90% below its M/A (prior close -5.63%)—Sell signal effective 03/08/2022.

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

Contact Ulli