- Moving the markets

Despite an early bounce, much of the gains were given back during the session with only the Nasdaq staying solidly in the green, while the other two major indexes clung to their respective unchanged lines.

The theme remained the same as those stocks, which are closely connected to the economic reopening, benefitted the most. That helped the tech sector and especially Small Caps to gain some footing, after the latter had been sliding ever since making an ATH the middle of February.

A positive outlook about the economy continues to be the center of discussion, with CNBC adding:

The optimism on the economy comes as U.S. average daily Covid cases fall below 25,000 and as nearly half the U.S. population has received at least one vaccination dose.

Bond yields went mostly sideways but edged a tad higher into the close, which was followed by the US Dollar index finally finding a reason to rally. That combination took the starch out of an early surge in Gold, with the precious metal surrendering its $1,900 level by a small margin.

It was a session where not much was lost and not much was gained. To me, it seems like another driver will be needed to push the major indexes higher.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

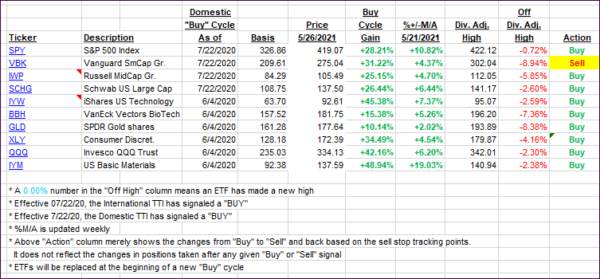

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge.

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs were mixed, but the Domestic one managed to eke out a gain.

This is how we closed 05/26/2021:

Domestic TTI: +17.18% above its M/A (prior close +16.78%)—Buy signal effective 07/22/2020.

International TTI: +15.33% above its M/A (prior close +15.37%)—Buy signals effective 07/22/2020.

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

Contact Ulli