- Moving the markets

After yesterday’s broad retreat, the Nasdaq managed an early bounce, which was quickly wiped out when the index changed direction and headed south while accelerating its demise for the day during the last hour.

SmallCaps had a wild and whacky day as well. Up strongly in the morning, the momentum faded with “value” and “growth” surrendering their early gains, but “growth” fared far worse than “value.”

In the end, the major indexes could not hold on to early advances and succumbed to the bears with the Dow holding up the best by ending essentially unchanged. While it seems that the markets continued to rotate out of high-flying growth names, it was disappointing to see that “value” ETFs were not able to hang on to their early boost.

Bond yields continued to the slip for the third straight day, but strangely enough that did not prevent or mitigate the sell-off. The 10-year yield dropped to 1.64% after having made a 14-month high last week.

The US Dollar Index resumed its rebound despite lower interest rates and scored 2-week highs. To make this even more confusing, gold rallied in unison with the Dollar. Huh?

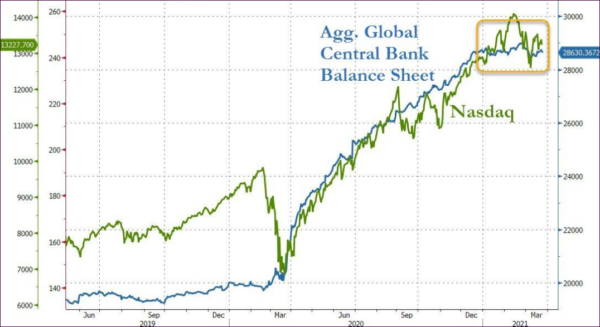

ZH explained the choppiness in the Bloomberg’s chart noting that the Central Bank Balance sheets have stagnated:

Time to activate up the printing presses, or this market will continue to go nowhere.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

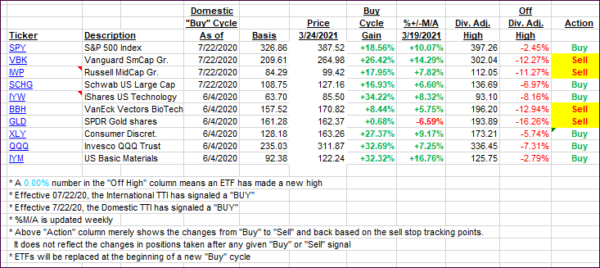

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge.

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs slipped again as the red was the preferred market color of the day.

This is how we closed 3/24/2021:

Domestic TTI: +16.14% above its M/A (prior close +16.29%)—Buy signal effective 07/22/2020.

International TTI: +14.92% above its M/A (prior close +15.51%)—Buy signals effective 07/22/2020.

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

Contact Ulli