- Moving the markets

For sure, the Turkish crisis has not been resolved, but it merely paused, as the emerging markets’ exchange rates rallied and had their best day in 3 weeks as this chart shows. ZH commented:

Of course, all eyes were on the Lira as it rallied back up to unchanged from Friday’s close… After its biggest single-day loss ever, the lira rebounded most since 2001…

So, the theme of the day that “the lira is fixed” was enough to bring back the bulls to push the major indexes out of yesterday’s doldrums and past last Friday’s closing prices. Sure, with nothing having been resolved in the emerging market arena, this rebound could very well turn out to be a dead cat bounce.

Of course, we won’t know for sure until more time passes, but with the US dollar’s relentless push to new cycle highs (made today), it’s questionable in my mind that emerging nations with dollar denominated debt can dig themselves out of the current hole when their currencies are heading south almost daily.

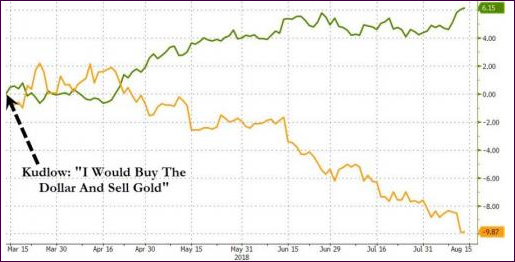

While no one can accurately forecast the future, there was an exception today, as Trump’s economist Larry Kudlow received honorable mention (tongue-in-cheek) by ZeroHedge, when he announced back in March that “I would buy the dollar and sell gold.” Here’s the chart:

An accurate call, but no big deal considering that he was on the inside looking out.

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

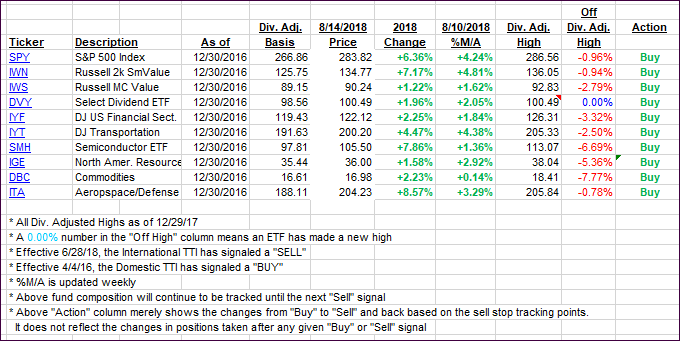

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how our candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) both improved, but uncertainty remained in the International arena, where we are stuck in neutral territory meaning it is still unclear which direction the major trend will take.

Here’s how we closed 08/14/2018:

Domestic TTI: +2.77% above its M/A (last close +2.44%)—Buy signal effective 4/4/2016

International TTI: -0.80% below its M/A (last close -0.93%)—Buy signal effective 7/26/2018

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli

Comments 4

I see that you, once again, have labeled today’s market movement as potentially a “…dead cat bounce.” Investopedia says this: DEFINITION of ‘Dead Cat Bounce’ A dead cat bounce is a temporary recovery from a prolonged decline or a bear market that is followed by the continuation of the downtrend. We’re far from being in a bear market. Can you address your definition of “dead cat bounce” and maybe compare and contrast your definition with Investopedia’s? I have always thought a dead cat bounce only occurred in bear markets.

Smokey

8/14/18

Smokey,

To me, there are many ways to use that term. Sure, your definition is correct, but I like to use it in a less narrow way. Domestic equities are still in a bull market, but the events in Turkey pulled the markets down, after which they rebounded the following day. Even though the issue that caused the stumble is still alive and well, I felt that this was just a short-term bounce with more downside to come. That’s exactly what happened today.

I personally don’t see the term “dead-cat-bounce” to be limited to use in bear markets only.

Ulli…

Hey, Ulli

In today’s edition of The ETF Bully, you make this startling comment: “…there is only one thing that has been responsible for the recent weakness in the markets as well as for the strength over the past 3 years.” Only one thing?? Only one thing! I trust (hope?) you were speaking rhetorically. Otherwise, everything else you and I track and trust is chaff.

Smokey

8/16/18

Smokey,

Yes, I guess I forgot to put my tongue-in-cheek disclaimer after that comment…

Ulli…