- Moving the market

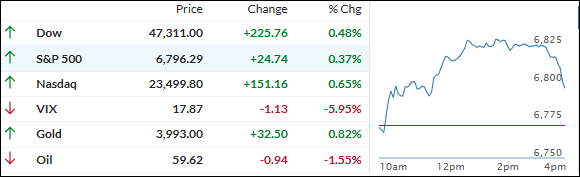

The major indexes snapped back from Tuesday’s shakeout, with buyers jumping back in and sending chipmakers like Advanced Micro Devices, Broadcom, and Micron Technology surging 3% to 6% as the broader artificial intelligence theme regained its footing.

Even Nvidia and Oracle managed to claw back some recent losses, hinting at fresh optimism in the high-flying tech sector.

The day’s rally came alongside some upbeat economic news: ADP payrolls and ISM services both topped expectations, signaling economic resilience.

That helped broaden out the gains, with positive breadth showing up across the market and small caps leading the way higher.

Meanwhile, the dollar’s recent climb paused, and bitcoin bounced off key support near $100,000.

Even though the Mag 7 basket lost some steam late in the day, the initial strength and improvement in market participation made for a more solid-feeling rally—at least for now.

Strong data also drove up bond yields, trimming odds of a third Fed rate cut in December. Gold nearly reclaimed its $4,000 mark, while silver pushed higher.

With the broader market joining in instead of just the AI favorites, will this turn into a more durable rally, or are traders just seizing another quick rebound before the next storm?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

Traders swept away the previous day’s gloom, returning in force to kick off a broad-based market rally.

Buying was steady throughout the session, and for a change, the advance was well-supported across most sectors—not just by big tech, but also by a wider swath of the market.

Our TTIs got in on the action too, with both posting moderate gains by the close. Improved market breadth added to a more optimistic outlook after recent narrow leadership had sparked caution.

This is how we closed 11/05/2025:

Domestic TTI: +4.68% above its M/A (prior close +4.07%)—Buy signal effective 5/20/25.

International TTI: +9.62% above its M/A (prior close +9.29%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli