- Moving the market

Better-than-expected retail sales provided an initial boost to the broad markets, while Microsoft’s announcement of a quarterly dividend hike further supported the tech sector. Additionally, Intel’s plans to make its foundry business a subsidiary led to a nearly 4% surge in its stock price.

Retail sales reportedly rose by 0.1% in August, a significant divergence from the anticipated 0.2% decline. Even when excluding autos, the figure still increased by 0.1%, though this was below the forecasted 0.2%.

Despite extensive discussions about tomorrow’s anticipated Federal Reserve rate cut, the current consensus is now pricing in a 70% chance of a 0.50% easing, a notable increase from Friday’s 47% probability.

A steeper rate cut could have unintended consequences, with traders potentially questioning the health of the economy, which historically has negatively impacted the S&P 500:

This scenario also brings inflation concerns back to the forefront, as inflation remains far from being under control, with the threat of stagflation still looming. Furthermore, the interest on U.S. debt has surpassed $1 trillion for the first time and is expected to reach $1.6 trillion by year-end. The August budget deficit, which exploded to a record high, exacerbates this issue.

If you think inflation has been conquered, think again. These deficits will have to be paid for with newly created money, potentially driving inflation into overdrive and sending gold prices soaring.

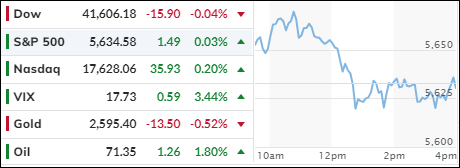

In the end, the major indexes saw little change, clinging closely to their respective unchanged lines. Small caps experienced volatility, with the most shorted stocks leading the charge but ending the session unchanged. The MAG7 basket followed a similar pattern, fading into the close.

Bond yields edged higher, allowing the dollar to rally modestly, which in turn pulled down gold from its lofty levels. Bitcoin surged above $61k, using yesterday’s dip to $58k as a springboard, while oil prices displayed a similar bullish trend.

Once again, we are witnessing a divergence between the S&P 500 and global liquidity, prompting ZeroHedge to ask:

Will global liquidity catch up to the equity market’s optimism?

2. Current “Buy” Cycles (effective 11/21/2023)

Our Trend Tracking Indexes (TTIs) have both crossed their trend lines with enough strength to trigger new “Buy” signals. That means, Tuesday, 11/21/2023, was the official date for these signals.

If you want to follow our strategy, you should first decide how much you want to invest based on your risk tolerance (percentage of allocation). Then, you should check my Thursday StatSheet and Saturday’s “ETFs on the Cutline” report for suitable ETFs to buy.

3. Trend Tracking Indexes (TTIs)

The markets struggled through a day of uncertainty, fluctuating without a clear direction as traders anxiously awaited the Federal Reserve’s most significant policy decision in years, scheduled for release tomorrow at 11 am PST.

In this atmosphere of anticipation, our TTIs remained relatively stable, concluding the day with only minor changes.

This is how we closed 09/17/2024:

Domestic TTI: +7.71% above its M/A (prior close +7.59%)—Buy signal effective 11/21/2023.

International TTI: +6.34% above its M/A (prior close +6.44%)—Buy signal effective 11/21/2023.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli