- Moving the markets

Apparently, Fed head Powell, Treasury Secretary Yellen and the head of the FDIC must have been in panic mode, as they combined forces by announcing (on Sunday) a plan that would backstop ALL depositors in the failed Silicon Valley Bank, while concurrently making additional funding available for other banks. Regional banks are not looking too good given their current losses, as well as the status of their regional bank index KRE.

The joint statement also assured depositors that they would have access to their money as of today. This action was the equivalent of pulling the cord for the backup parachute, as the domino effect of citizens withdrawing their funds would have accelerated with lightning speed.

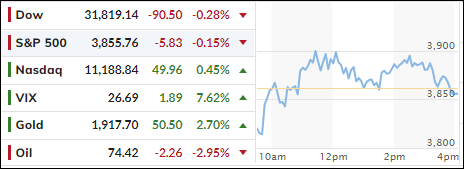

As a result, bond yields plunged and equity indexes, while up solidly in overnight trading, seesawed and ended the session close to their respective unchanged lines. This emergency action does not mean this crisis has been resolved, no, it has been merely halted, as the Fed is trying to ascertain, if other banks are experiencing a similar liquidity shortage (spoiler alert: yes, there are many more cockroaches).

ZeroHedge highlighted that the 2-year yield plunged almost 100bps in the last three days to below 4%, which was its lowest since September 2022. This three-day drop in yield has been the biggest since “Black Monday” in 1987. Hmm…

Looking at the big picture, this event could very well mean the end of the Fed’s aggressive stance on interest rates, as rate hike expectations dropped sharply. The question remains now: “will they hike 0.25% at their next meeting, or will they pause?” For sure, the 0.5% hike option just died over the weekend.

The US Dollar declined to three-week lows and, as you might expect in times of stress and uncertainty, Gold spiked above $1,900, a move of +2.66% for the day.

The fireworks are far from being over with the CPI, US retails sales, PPI, and housing data all on deck and waiting to make their mark on the markets.

2. “Buy” Cycle Suggestions

For the current Buy cycle, which started on 12/1/2022, I suggested you reference my then current StatSheet for ETF selections. However, if you came on board later, you may want to look at the most recent version, which is published and posted every Thursday at 6:30 pm PST.

I also recommend for you to consider your risk tolerance when making your selections by dropping down more towards the middle of the M-Index rankings, should you tend to be more risk adverse. Likewise, a partial initial exposure to the markets, say 33% to start with, will reduce your risk in case of a sudden directional turnaround.

We are living in times of great uncertainty, with economic fundamentals steadily deteriorating, which will eventually affect earnings negatively and, by association, stock prices. I can see this current Buy signal to be short lived, say to the end of the year, and would not be surprised if it ends at some point in January.

In my advisor practice, we are therefore looking for limited exposure in value, some growth and dividend ETFs. Of course, gold has been a core holding for a long time.

With all investments, I recommend the use of a trailing sell stop in the range of 8-12% to limit your downside risk.

3. Trend Tracking Indexes (TTIs)

Our TTIs dropped again, as the indexes failed to maintain early upward momentum and slid into the close. We still need a little more downside confirmation before I consider this “Buy” signal to be over. However, one of our trailing sell stops was triggered, and I will liquidate that position tomorrow.

This is how we closed 03/13/2023:

Domestic TTI: -1.99% below its M/A (prior close -0.79%)—Buy signal effective 12/1/2022.

International TTI: +3.76% above its M/A (prior close +5.06%)—Buy signal effective 12/1/2022.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

Contact Ulli