ETF Tracker StatSheet

You can view the latest version here.

ANOTHER ROLLER COASTER RIDE

- Moving the markets

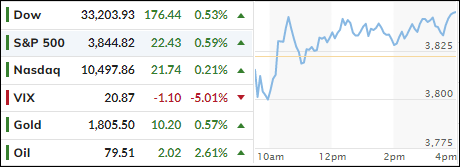

While Wednesday’s rebound rekindled thoughts of a Santa Claus rally, those hopes were wiped out yesterday, when the markets got clubbed and surrendered all the prior day’s gains. The S&P 500 closed yesterday exactly at Wednesday’s level. Go figure…

Thursday, the markets threw a tantrum with Tesla plunging 11%. Hedge fund guru David Tepper threw more gasoline on the fire by commenting that traders should not ignore what the central bankers are saying:

I would probably say I’m leaning short on the equity markets right now because the upside/downside doesn’t make sense to me when I have so many Central banks telling me what they are going to do, what they want to do, what they expect to do.

Not helping matters was an unexpectedly hot 3.2% GDP number (above the 2.9% estimate), which was good news, as far as the economy is concerned, but bad news for equities, with traders fearing that the much hoped for Fed pivot remains nothing but wishful thinking.

Today, the bulls managed to tip the scales slightly in their favor but, given the losses for the past 5 trading days, the S&P and Nasdaq declined for a third straight week. Recession fears continue to batter sentiment, as the following mixed data points kept traders on edge:

- The Fed’s favorite inflation indicator (PCE) came in hotter than expected (+4.7% YoY vs. +4.6% expected.

- US Inflation Expectations tumble to 18-month lows

- US Durable Orders plunge in November, biggest drop since Covid

- US New Home Sales unexpectedly soar in November

No wonder that the markets are non-directional with weak numbers bringing recession fears and strong numbers creating Fed fears, as MarketWatch put it. Hard data and soft data seem to be converging, as ZeroHedge pointed out, which does not favor a soft landing.

Bond yields surged this week with the 10-year taking the lead by gaining 26 bps to close at 3.75%, while the US Dollar slipped, yet Gold ended the week unchanged after zig-zagging the entire December.

If traders don’t step up to the plate and create some bullish momentum during the last 4 trading days of 2022, tech stocks will end up notching their 2nd worst December ever.

Have a very Merry Christmas!

2. “Buy” Cycle Suggestions

For the current Buy cycle, which starts on 12/1/2022, I suggest you reference my most recent StatSheet for ETFs selections. If you come on board later, you may want to look at the most current version, which is published and posted every Thursday at 6:30 pm PST.

I also recommend for you to consider your risk tolerance when making your selections by dropping down more towards the middle of the M-Index rankings, should you tend to be more risk adverse. Likewise, a partial initial exposure to the markets, say 33% to start with, will reduce your risk in case of a sudden directional turnaround.

We are living in times of great uncertainty, with economic fundamentals steadily deteriorating, which will eventually affect earnings negatively and, by association, stock prices. I can see this current Buy signal to be short lived, say to the end of the year, and would not be surprised if it ends at some point in January.

In my advisor practice, we are therefore looking for limited exposure in value, some growth and dividend ETFs. Of course, gold has been a core holding for a long time.

With all investments, I recommend the use of a trailing sell stop in the range of 8-12% to limit your downside risk.

3. Trend Tracking Indexes (TTIs)

Our TTIs made some headway with the Domestic one now back within a hair of crossing its trend line to the upside. We are in neutral territory, and a breakout could occur in either direction.

This is how we closed 12/23/2022:

Domestic TTI: -0.08% below its M/A (prior close -1.39%)—Buy signal effective 12/1/2022.

International TTI: +1.60% above its M/A (prior close +0.96%)—Buy signal effective

12/1/2022.

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli