- Moving the markets

I have been commenting almost daily on last week’s rally, which was entirely based on wishful thinking that the Fed will have to pivot back to lowering rates. Due to the US having slipped into a recession, traders, who have been frontrunning the market, expected that this event will have to happen sooner rather than later.

However, today, we saw a parade of Fed speakers debunking the hope for a Fed pivot by presenting nothing but hawkish thoughts. ZeroHedge summed up the speakers like this:

SF Fed’s Mary Daly jawboned the doves back by stating that The Fed is “nowhere near done” on fighting inflation, adding that “we have made a good start, and I feel really pleased with where we’ve gotten to by this point,” but inflation is “far too high.”

“It really would be premature to unwind all of that and say the job is done,” she said.

“I also think that we’ve been with this high inflation for a while, and really getting too confident that we’ve already solved the problem,” Daly said, adding that the Fed needs to “keep committed until we actually see it in the data.”

Chicago Fed President Charles Evans said he is hopeful that reaching 3.5% by the end of the year is “still reasonable.”

“I think that there’s enough time to play out that 50 is a reasonable assessment, but 75 could also be okay” at the September meeting, he said.

“I doubt that more would be called for” at that meeting, Evans added. But Evans warned that “if we don’t see improvement before too long, we might have to rethink the path a little bit higher.”

Cleveland Fed’s Loretta Mester said she saw “no signs of a recession” offering no dovish pivot signal by noting that “we have to get inflation under control.”

To really drive the point home, Mester concluded that she “hasn’t seen anything suggesting inflation is leveling off.”

As a result, rate hike expectations headed north and the markets went south, although the losses were moderate. The early rebound happened with the support of a short squeeze, which petered out in the afternoon.

Bond yields surged with the 5-year scoring its biggest daily rise since 3/17/20, according to ZeroHedge. The widely followed 10-year rallied almost 18 bps to close at 2.75%.

With rising yields, it came as no surprise that the US Dollar gained and gold dropped after briefly piercing the $1,800 level.

Adding to those uncertainties was Nancy Pelosi’s much debated and questioned “visit” to Taiwan, which for sure increased US/China tensions with any repercussions still being unknown. Anxieties could even worsen once she tries leave tomorrow after spending the night on the island.

Interestingly, Blomberg noted that “company executives are getting much more worried about economic growth, judging by their earnings conference calls,” even as stocks staged a furious rebound in July.

Hmm…I wonder how that will affect future market behavior.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

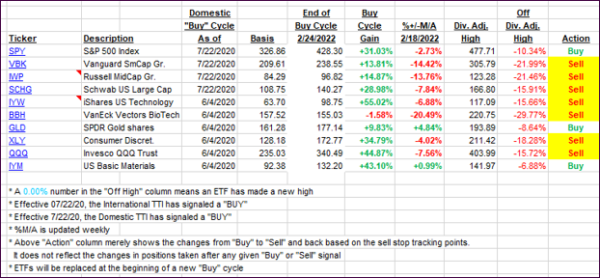

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this closed-out domestic “Buy” cycle (2/24/2022), here’s how some of our candidates have fared. Keep in mind that our Domestic Trend Tracking Index (TTI) signaled a “Sell” on that date, which overrode the existing “Buys” shown for SPY and IYM:

Click image to enlarge.

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -12% point has been taken out in the “Off High” column, which has replaced the prior -8% to -10% limits.

3. Trend Tracking Indexes (TTIs)

Our TTIs dropped as negative market sentiment ruled.

This is how we closed 08/02/2022:

Domestic TTI: -3.88% below its M/A (prior close -3.20%)—Sell signal effective 02/24/2022.

International TTI: -8.49% below its M/A (prior close -7.32%)—Sell signal effective 03/08/2022.

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

Contact Ulli