ETF Tracker StatSheet

You can view the latest version here.

DOMESTIC TREND TRACKING INDEX (TTI) CROSSES INTO BULLISH TERRITORY

- Moving the markets

During yesterday’s morning rebound, my proprietary Domestic Trend Tracking Index (TTI) peeked above its long-term trend line into bullish territory. Weakening afternoon momentum pulled the index back below its line, but I took the opportunity to already ease back into the equity market.

Today’s follow through finally pushed the TTI into bullish territory for the first time since our effective “Sell” signal on 2/24/2022. See section 3 below for more details.

This may turn out to be the point in time where a bear market rally morphs into a new bull market with the only question being as to how long this condition will last.

All this positive action, with the S&P 500 now having risen for the fourth straight week, was based on nothing but hope that the Fed will soon have to pivot towards a lowering of the interest rates, as the economy worsens.

Wednesday’s 8.5% CPI reading was heralded as a defining moment, in that we may have already reached peak inflation, an assumption that will turn out to be as wrong as the year long view that inflation was transitory. However, for the time being, traders and algos alike are content riding the bullish bandwagon.

Added ZeroHedge:

Today’s melt up was especially memorable, as it not only cemented the Nasdaq’s new bull market, but sent the broader market up more than 3% for the week, its 4th consecutive week of gains (starting with the week when Powell announced “we’re at neutral”) the longest stretch of gains since November…

As a result, we saw a sea of green across every sector with SmallCaps as well conquering their long-term trend line. Just as much attention will be given once the S&P 500 crosses its widely followed 200-day M/A, which will only take a gain of about 1.2%.

From a big picture view, ZeroHedge is spot on with this observation:

Yet for all the melt up euphoria, a casual look at what lies ahead brings up storm clouds because unless earnings rebound – and with margins collapsing that’s unlikely – the markets will need to see multiple expansion, which however is unlikely unless real yields drop turn negative again…which however is especially unlikely since the Fed will have to aggressively step in and contain the market’s froth which has undone the tightening from the latest 150bps of Fed rate hikes…

In other words, don’t count on the Fed of not making another hawkish move, or two, something that the various Fed governors have frequently confirmed, as recently as a week ago, but which seems to have been conveniently forgotten.

If you decide to participate in this market, I can only advise you to do so with a clearly defined exit strategy, because we are living in an economic and political environment where things could reverse at a moment’s notice.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

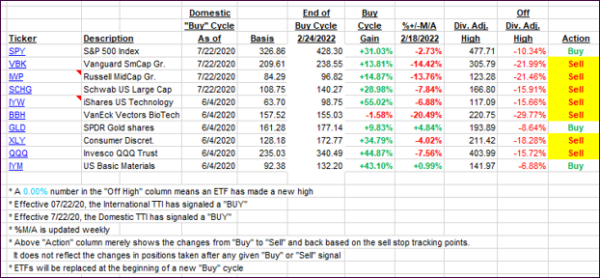

For this closed-out domestic “Buy” cycle (2/24/2022), here’s how some of our candidates have fared. Keep in mind that our Domestic Trend Tracking Index (TTI) signaled a “Sell” on that date, which overrode the existing “Buys” shown for SPY and IYM:

Click image to enlarge.

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -12% point has been taken out in the “Off High” column, which has replaced the prior -8% to -10% limits.

3. Trend Tracking Indexes (TTIs)

Our TTIs ramped higher again with the Domestic one now having crossed above its line and into bullish territory. In my advisor practice, we already added a position yesterday, but I will wait a few days to ascertain that there is staying power before issuing a new official Buy signal.

This is how we closed 08/12/2022:

Domestic TTI: +1.20% above its M/A (prior close -0.54%)—Sell signal effective 02/24/2022.

International TTI: -4.29% below its M/A (prior close -5.23%)—Sell signal effective 03/08/2022.

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli