ETF Tracker StatSheet

You can view the latest version here.

TROUNCING AND BOUNCING

- Moving the markets

After the Dow dropped another 400 points to start the session, dip buyers stepped in and pushed the major indexes just above their unchanged lines. Giving an assist in this sudden turnaround, was Fed mouthpiece Kashkari by hinting that the Neutral rate is 2%, which means the Fed has at most a little over 1% in hikes left, before it may have to shift in reverse.

While that was just his opinion, it had the desired dovish effect in that it instantly reversed the bearish course of the day. That statement differed substantially from traders’ expectations of another 12 rate hikes or so and caused the bulls to come out of hiding.

However, it was not enough for a complete turnaround, but it continued the market’s bobbing and weaving thereby avoiding another carnage. In the end, the major indexes scored another loss, with the Dow now having dropped for six straight weeks.

Thanks to Wednesday’s powerful dead-cat bounce, AKA Fed relief rally, the S&P 500 closed the week just about unchanged but registered its longest weekly losing streak since June 2011, according to ZeroHedge.

Bond yields claimed most of the attention, as the 10-year touched 3.13% for the first time since 2018, after which the Fed folded and reversed its policies thereby reviving the dying bull market. With inflation continuing to be on the rise, it’s unknown whether the Fed will stick to its plan or will favor bailing out the stock and bond markets again.

The winners of the day were energy, commodities, gold and the short 20-year Treasury ETFs, the exposure to which has, despite their volatility, created a bullish oasis, as most other sectors were mired in red numbers.

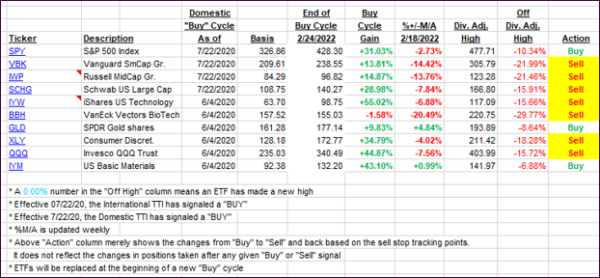

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this closed-out domestic “Buy” cycle (2/24/2022), here’s how some of our candidates have fared:

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -12% point has been taken out in the “Off High” column, which has replaced the prior -8% to -10% limits.

3. Trend Tracking Indexes (TTIs)

Our TTIs slipped again, with the markets not yet having found a firm bottom.

This is how we closed 05/06/2022:

Domestic TTI: -5.01% below its M/A (prior close -4.22%)—Sell signal effective 02/24/2022.

International TTI: -6.20% below its M/A (prior close -5.99%)—Sell signal effective 03/08/2022.

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details.

Contact Ulli