- Moving the markets

The bulls and bears were engaged in a tug-of-war session with the former seemingly storming ahead only to be pulled back down to reality by the latter. Gains came and went and, when the closing bell rang, only the Dow & S&P 500 were able to barely stay above their respective unchanged lines.

The culprit was the same as yesterday, namely bond yields, which rode the roller coaster again with the 10-year first dropping to 1.5% and then swinging higher in afternoon trading into the 1.54% area.

The Nasdaq followed this trend by being higher early on, as rates eased, but then lost altitude as yields again marched higher. As a result, the pressure was on “growth” with “value” and Small Caps benefiting.

Giving an assist to bearish sentiment was the ongoing Washington debacle with debt ceiling doubts sending questionable messages to the international community about the ability of the USA to fulfill its obligations.

Choppy and sloppy best describes today’s equity moves, as dip buyers where present during the session but absent late in the day, as equities came off their highs. It now looks like the S&P 500 is on track to score its first monthly decline since January.

Zero Hedge called it this way:

While rising bond yields, Fed tapering, the delta variant and inflation help explain that, all of those will slow profit growth after rising earnings estimates and big beats helped fuel 2021’s stock rally until now with an always-optimistic eye for the ‘recovery’ and ‘return to normal’ that now seems ever further away.

The US Dollar index, in the face of higher bond yields, continued its northerly path by registering its biggest 2-day jump since June, and it seems to be closing this September on a high note, just as it did in 2020.

Again, higher bond yields and a rallying dollar combined to take the starch out of Gold which, despite a mid-day rally, was not able to hold on and retreated -0.72%.

So far, the analog to 1987 is right on track, as Bloomberg’s chart shows.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

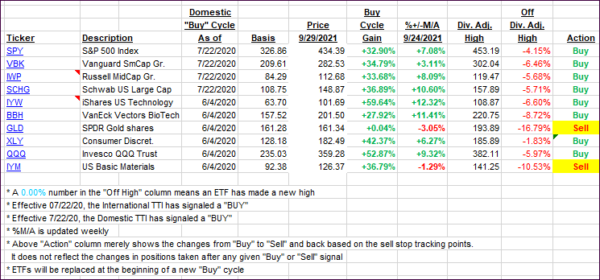

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge.

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs showed a mixed picture when the Domestic one retreated and the International once gained.

This is how we closed 09/29/2021:

Domestic TTI: +5.32% above its M/A (prior close +5.10%)—Buy signal effective 07/22/2020.

International TTI: +2.51% above its M/A (prior close +2.74%)—Buy signal effective 07/22/2020.

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

Contact Ulli