ETF Tracker StatSheet

You can view the latest version here.

CLOSING A WINNING WEEK ON A POSITIVE NOTE

- Moving the markets

New records were set again today, as the Dow and S&P 500 continued their ascent to ever new highs. Strong earnings from blue chip companies gave the assist, as well as data signaling that the economy has maintained its recovery.

We learned that the Consumer Sentiment Index rose to a one-year high, while Fed Gov Waller supported the bullish mood by remarking that despite the US economy taking off, there would be no reason to start tightening policy.

The last of the six largest banks, Morgan Stanley, posted stronger than expected results helping the financial ETF XLF to register a solid gain.

All three major indexes closed in the green, led by the Dow and S&P 500, with the Nasdaq being the weakling as the index barely crawled back above its unchanged line.

Bond yields bounced a tad today but remain under the 1.6% level for the 10-year. The US Dollar continued its slide, but Gold found some unexpected support, after China announced this (via ZH):

The People’s Bank of China (PBOC), the nation’s central bank, controls how much gold enters China through a system of quotas given to commercial banks. It usually allows enough metal in to satisfy local demand but sometimes restricts the flow.

In recent weeks it has given permission for large amounts of bullion to enter, the sources said.

“We had no quotas for a while. Now we are getting them … the most since 2019,” said a source at one of the banks moving gold into China.

Around 150 tons of gold worth $8.5 billion at current prices is likely to be shipped, four sources said. Two of the sources said the bullion would be shipped in April. Two others said it would reach China over April and May.

If that trend continues, we might see gold’s upward momentum finally reestablish itself, supported also by inflationary pressures, the likes of which we are all aware of, but which has been ignored by the Fed.

Be that as it may, for the time being, traders and analysts are viewing the current market environment as a “goldilocks” scenario and further advances are likely.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

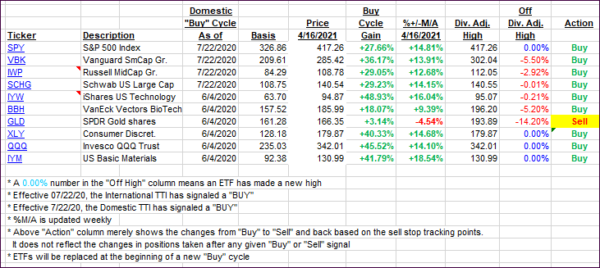

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge.

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs came off their highs by a slight margin.

This is how we closed 4/16/2021:

Domestic TTI: +19.97% above its M/A (prior close +20.51%)—Buy signal effective 07/22/2020.

International TTI: +17.05% above its M/A (prior close +17.28%)—Buy signals effective 07/22/2020.

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details here.

———————————————————

Back issues of the ETF Tracker are available on the web.

Contact Ulli