- Moving the markets

An early bounce in the markets disappeared in a hurry with tech shares struggling in part due to the Federal Trade Commission and state attorneys general led by New York filing an antitrust complaint against Facebook. The allegations include stifling of competition to protect its monopoly power.

That announcement took down the tech sector the most, with the Nasdaq surrendering almost 2%, but the other two major indexes stumbled as well. However, given the fact that we were hovering in record territory, today’s pullback was modest and in line of what you might expect after scoring all-time highs.

“I think we’re having a bit of a digestion day after hitting new highs,” said Keith Lerner, chief market strategist at Truist. “There’s some hesitation because of the stimulus talks, but leadership still shows the market is leaning toward something happening” on that front. Lerner pointed out that small-cap stocks weren’t down as much as the large-cap indexes.

Of course, the battle over the relief bill went on full force and took the starch out of the early levitation, after McConnell slammed Schumer over the relief package rejection.

ZH summed up the tit for tat like this:

*MCCONNELL SAYS DEMOCRATS MOVING GOALPOSTS ON AID BILL

*MCCONNELL SAYS SCHUMER, PELOSI BRUSHING OFF GOP AID PROPOSALS

*MCCONNELL SAYS DEMOCRATS NEED TO DECIDE TO MAKE LEGISLATION

FANG stocks got hammered with JP Morgan analyst Ryan Brinkman not helping matters when opining that those shares were “drastically” overvalued.

The usual support from the well-documented short squeezes was conspicuously absent when that sector suffered its biggest loss since the end of October.

The US Dollar did a turnaround and spiked higher thereby putting the pressure on gold with the precious metal giving back its hard-fought gains of the recent past.

With equities being sold, you would have expected bonds to rally, but that did not happen; yields rose pulling down bond prices.

In the end, it was just of those days where there was simply no place to hide.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can again.

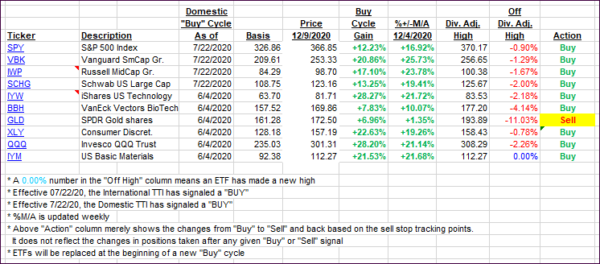

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs were mixed again with the International gaining, while the Domestic one slipped.

This is how we closed 12/09/2020:

Domestic TTI: +21.96% above its M/A (prior close +22.36%)—Buy signal effective 07/22/2020

International TTI: +20.79% above its M/A (prior close +20.63%)—Buy signal effective 07/22/2020

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

Contact Ulli