ETF Tracker StatSheet

You can view the latest version here.

SAME NEWS, DIFFERENT DAY

- Moving the markets

The futures markets already indicated a continuation of this week’s directionless pattern, which dominated the regular session as well.

The usual suspects contributed to uncertainty, as the Brexit talks appeared to be collapsing, the much hoped-for stimulus package is still delayed, coronavirus infections are surging and who knows what the true status of the latest vaccine story really is.

In case you missed it, ZH clarified some of the issues preventing a stimulus package from being agreed on:

1. Republicans want liability for businesses. Democrats don’t.

2. Democrats want more state aid and Republicans don’t.

3. Trump wants another broad round of checks. Neither a majority of Republicans nor Democrats want that, but the Progressives side with Trump, a curious mix.

At least the House and Senate passed a one-week federal spending extension to not only avoid a shutdown through December 18 but to also reach a stimulus agreement perhaps.

Equities were lower this week across the board with the S&P 500 shedding about 1%, but only SmallCaps bucked the trend and managed to eke out some gains.

The US Dollar behaved like a penny stock and swung wildly, as Bloomberg’s chart shows, while bond yields rose for the week. Despite big intraday swings, gold ended the week unchanged.

Sooner or later, I expect the stimulus tug-of-war games in Washington to come to an end with an agreement reached. Once that happens, the computer algos could very use that as a new inducement and levitate equities to provide us with a much hoped-for year-end rally.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can again.

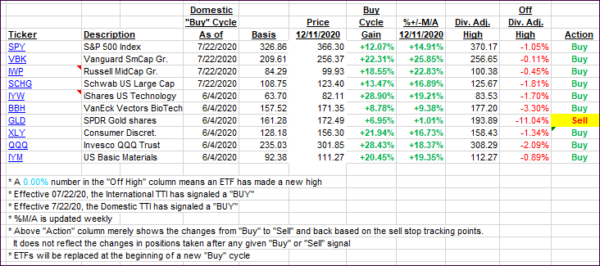

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs slipped as the markets still meandered in a sideways to down pattern.

This is how we closed 12/11/2020:

Domestic TTI: +20.21% above its M/A (prior close +22.07%)—Buy signal effective 07/22/2020

International TTI: +18.86% above its M/A (prior close +20.80%)—Buy signal effective 07/22/2020

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details here.

———————————————————

Back issues of the ETF Tracker are available on the web.

Contact Ulli