- Moving the markets

The futures started things out by rallying sharply based on Europe data showing new corona virus cases growing at the slowest rate in months. That was followed by the US markets jumping right after the opening bell, because of drug maker Moderna announcing positive early results from its first human trial of its experimental Covid-19 vaccine.

The press release said:

“All eight initial participants” in the Moderna trial developed neutralizing antibodies to the virus at levels reaching or exceeding those seen in people who have naturally recovered from Covid-19.”

Hmm. Eight participants? And that is a market moving occurrence?

All of this was prefaced by the main event, namely Fed head Powell appearing on CBS’s 60 Minutes and proclaiming, “don’t bet against the American economy,” even though unemployment could rise to 25%.

His thoughts about the likelihood for a rebound of an economy that is showing signs of extreme stress were hopeful but guarded, because a second wave of infections could rattle confidence further. However, his promise “to do whatever it takes,” sparked the greatest opening buying pressure in history this morning, as ZH demonstrates with this chart.

And to clarify, ZH added:

“We soared on the back of Fed fears and promises to print more due to bad news, and we soared on positive vaccine headlines which would end the bad news.”

Powell also admitted that the unemployment rate could shoot up sharply and reach levels not seen since the Great Depression. But he was not worried about a second depression and projected an economic rebound to materialize during the second half of the year.

In the end, it was only his upbeat tone that propelled strocks higher, as well as his insistence that the central bank still is in possession of tools to limit the economic fallout from Covid-19. Sure, continued money printing is and will always be the #1 choice.

We all know that the long-term effect will be hyperinflation, but before that condition kicks in, we might see the markets pushed to unthinkable levels, as inflation first shows up and manifests itself in bond and equity prices.

Today was a start in that direction, but we’ll have to see if these levels hold and can form a base for further advances. Our Domestic Trend Tracking Index (TTI) improved by a substantial percentage (section 3), but it will take another leg higher until a new “Buy” is generated.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

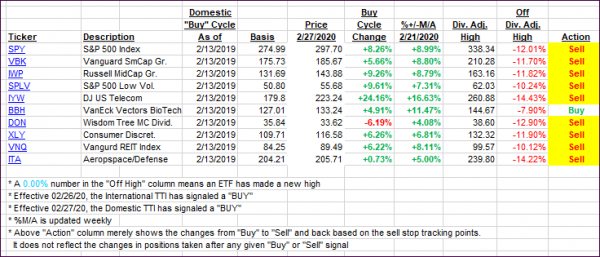

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this past domestic “Buy” cycle, which ended on 2/27/2020, here’s how some our candidates have fared:

Click image to enlarge

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs improved markedly with the especially the Domestic one taking a big jump towards its trend line. However, it will take more upside momentum to generate a new Domestic “Buy” signal.

This is how we closed 05/18/2020:

Domestic TTI: -7.82% below its M/A (prior close -12.60%)—Sell signal effective 02/27/2020

International TTI: -10.80% below its M/A (prior close -13.96%)—Sell signal effective 02/26/2020

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

Contact Ulli