- Moving the markets

Hope of a reopening of the economy kept the bullish theme alive with the computer algos feasting on the latest news that the worst human toll of the coronavirus may have passed.

ZeroHedge summed it up like this:

In case stocks needed another reason to soar higher with 20% unemployment, 30% mortgage defaults, GDP about to print at -40%, cratering corporate profits, JPMorgan profit crashing 69% with Jamie Dimon warning of a “severe recession”, Boeing delivered moments ago when the company reported that customers cancelled a record number of orders for the 737 Max lead balloon last month, deepening the crisis the company faces between the coronavirus pandemic which has virtually frozen all commercial air flight and the continued grounding of its best-selling plane after two fatal crashes.

We’re staring the most likely worst ever earnings season in the face, and the markets rally, because fundamentals no longer matter, as I have repeatedly noted. Analyst Bill Blain sees it like this:

Massive monetary stimulus through QE Infinity, and unlimited fiscal support via the promise of sector and company bailouts and nationalizing payrolls, have fueled the market’s expectations rally. NOT BECAUSE OF A STRONGER ECONOMIC OUTLOOK OR RISING COMPANY RESULTS. Distortion and disconnect is not sustainable long-term (although it’s pretty much fueled markets since 2009).

The expectation is Central Banks can’t allow a market meltdown. Follow the Fed… you won’t lose.

Right now, the focus remains on the reopening of the economy with some erroneously expecting this to be like flipping a switch and voila… there is a V-shaped recovery, while the second half of the year already has some sort of normalcy priced in.

I think it will be a slow process, much slower than expected, of getting back to normal. I simply do not believe that people will rush out to restaurants or get involved in large gatherings the moment the shutdown is lifted.

Even Neel Kashkari, the head of the Federal Reserve Bank on Minneapolis, painted a gloomy, or let’s call it more realistic, picture via these comments:

“America should be ready for 18 months of shutdowns in ‘long, hard road’ ahead.”

“This could be a long, hard road that we have ahead of us until we get to either an effective therapy or a vaccine. It’s hard for me to see a V-shaped recovery under that scenario.”

Be that as it may, with the Fed being in full support mode of the markets, we could very well see the return to a bullish cycle, or, we could witness a total breakdown with the a visit of the March lows being a real possibility.

That’s why we must make sure that we don’t succumb to the desire of bottom fishing but be patient and wait, until the odds have improved and our Trend Tracking Indexes (section 3) are signaling the green light again.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

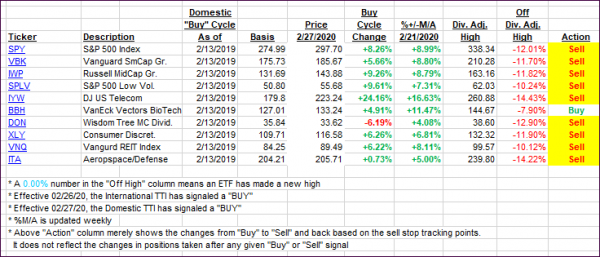

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this past domestic “Buy” cycle, which ended on 2/27/2020, here’s how some our candidates have fared:

Click image to enlarge

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

In my advisor practice, we may or may not be invested in some of the 10 ETFs listed above.

3. Trend Tracking Indexes (TTIs)

Our TTIs rebounded as hope for a reopening of the economy reigned supreme.

Here’s how we closed 04/14/2020:

Domestic TTI: -12.60% below its M/A (prior close -14.85%)—Sell signal effective 02/27/2020

International TTI: -13.44% below its M/A (prior close -15.08%)—Sell signal effective 02/26/2020

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

Contact Ulli