- Moving the markets

It comes as no surprise that after last week’s market drubbing, a rebound of some sort was in order. One analyst quipped by posting the question: Can a cat with a coronavirus bounce?

At least for right now, it seems that way, as the major indexes, motivated and supported by the Bank of Japan’s (BoJ) massive buying of almost $1 billion US dollars in stock ETFs, designed to stabilize markets, helped to create an overall positive sentiment to start the week.

So far, the Fed has been quietly absent and may have second thoughts about intervening in the markets, other than jawboning last Friday that “the coronavirus poses evolving risks to economic activity. The Federal Reserve is closely monitoring developments and their implications for the economic outlook. We will use our tools and act as appropriate to support the economy.”

Of course, expectations keep growing that Central Bankers will act in unison to attempt to stem the economic fallout from the virus. Still, traders are anxiously watching to see for how long not only supply chains, but also future corporate earnings will be affected.

I found analyst’s Mike Whitney’s summary most appropriate:

“Well, next week the Fed will announce that it is slashing rates by 50 basis points and that it’s coordinating its action with its fellow central banks, the BoE, the BoJ, and the ECB.

The Fed might also announce an additional liquidity program aimed at banks and financial institutions that suddenly find they themselves unable to borrow at the Fed’s discount rate.

The announcement could ignite a relief rally, but the surge is not likely to last long since it will not have any material effect on either the virus or the disruptions to supply-lines. The Fed’s easy money will not create the Chinese-made components that laptop manufacturers need to sell their products.

They won’t put skittish workers back in the factories or passengers back on airplanes or consumers back in the retail stores. The Fed’s low rates are designed to stimulate demand, but they do nothing to mitigate a “supply shock”. Regrettably, the problem is on the supply side not the demand side.”

Right now, the markets are looking to stop last week’s bleeding. It will take a little more than a one-day reflex rally, based on intervention hopes, to re-establish the bullish trend.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can again.

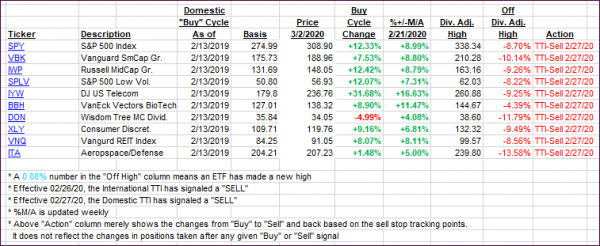

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs recovered, as intervention hopes, along with Japan’s massive buying of stock ETFs, combined to create a formidable rebound. It’s too early to tell if it’s of the dead-cat bounce variety.

Here’s how we closed 03/02/2020:

Domestic TTI: -2.36% below its M/A (prior close -5.82%)—Sell signal effective 02/27/2020

International TTI: -4.33% below its M/A (prior close -6.61%)—Sell signal effective 02/26/2020

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

Contact Ulli