ETF Tracker StatSheet

You can view the latest version here.

SLAMMED BY THE VIRUS

- Moving the markets

Even Amazon’s strong quarterly results, and its subsequent 9% jump in stock price, could not stem the slide, as the ongoing coronavirus epidemic continued full force, with travel and trade disruptions now becoming a more real threat to economic growth prospects.

Yesterday’s rebound of the indexes now appears to have been a dead-cat-bounce, as a sea of red numbers dominated computer screens throughout the world. Beijing so far has reported over 9,600 cases of the virus with a death toll of 213. These are only the official numbers, and, by today’s market reaction, it appears that more bad news is expected over the weekend.

Whenever markets are subjected to the unknown, pullbacks are the usual reactions, especially when considering the relentless levitation of the past few months. At the same time, some analysts are considering this to be “a full valuation” market, which can contribute to corrections as well, especially when the bond market continues to show the kind of decoupling I posted about yesterday.

Then the CDC (Center of Disease Control) held another press conference during which it reiterated, several times, that the risk to the public from the coronavirus is low, but they forgot to mention that the risk to current market levels is high.

All eyes are now on China, whose markets will re-open on Monday after the weeklong Lunar Holiday closure. In the meantime, entire Chinese cities and factory hubs are on lockdown with some 50 million people being confined to their homes.

One look at the big picture, namely the driver for this bull market, also known as the Fed’s balance sheet, we see a different reason for this sell-off emerge, which is the lack of expansion of this very balance sheet, as this chart makes abundantly clear.

In the absence of this balance sheet picking up some upside momentum, and the coronavirus being contained, we could potentially see this bull market come to a screeching halt.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can again.

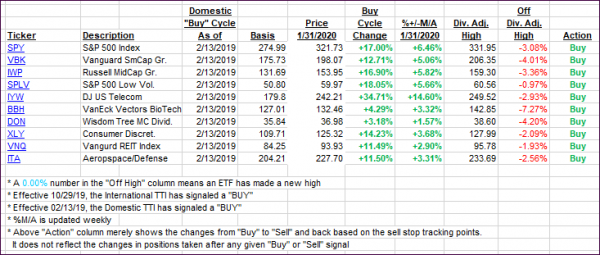

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) took a dive and headed closer towards their respective trend lines. Despite this pullback, the major uptrend has not been violated and all ‘Buy’ signals remain intact.

Here’s how we closed 01/31/2020:

Domestic TTI: +4.45% above its M/A (prior close +6.74%)—Buy signal effective 02/13/2019

International TTI: +2.55% above its M/A (prior close +3.71%)—Buy signal effective 10/29/2019

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details here.

———————————————————

Back issues of the ETF Tracker are available on the web.

Contact Ulli