ETF Tracker StatSheet

You can view the latest version here.

WAR DRUMS KEEP MARKETS IN CHECK

- Moving the markets

The markets pulled back today as a result of the US counterstrike in Iran, which focused on taking out a high-ranking military commander. Obviously, that escalated Middle East tensions with threats like “hard revenge awaits criminals,” that made headlines around the world.

Sure, the prospect of an Iranian retaliation could keep stocks hanging in limbo for a while, as traders are somewhat unnerved and concerned about a possible fallout, which would occur if the Straits of Hormuz were to be closed.

That potential threat was already acknowledged by oil rallying almost 3%, while the other two safety havens, namely gold and bond yields, were bid higher, an event that always happens when geopolitical tensions heat up.

We will have to wait and see what develops over the weekend and next week to judge if this will be just a temporary interruption of bullish momentum, of if it develops into something more.

One other event that is sure to influence markets is the Fed’s planned liquidity drain next week. As ZH points out correctly, if the Fed’s balance sheet goes up, so does the S&P 500, and vice versa. This chart clearly demonstrates this correlation. You can see that the Fed’s balance sheet rose 11 of 12 weeks and declined in just 1 of 12, and if my magic, so did the S&P.

However, the Fed pointed out its “expectations to gradually transition away from active repo operations (in 2020) as T-Bill purchase supply a larger base of reserves.” What that simply means is that maturing term repos will not be rolled over, which translates to an upcoming drain in liquidity:

- $25 billion leaves the market on Monday,

- $28.8 billion on Tuesday,

- $18 billion next Friday, etc.

Hmm, markets have been reacting positively to increases in liquidity, which makes me wonder how they will react to decreases in liquidity.

For sure, the next couple of weeks promise to be anything but boring.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

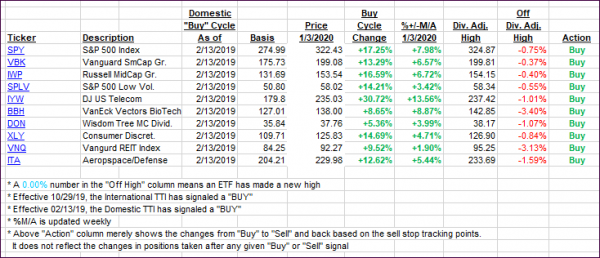

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) headed in reverse as Middle East tensions pulled the major indexes off their lofty levels.

Here’s how we closed 01/03/2020:

Domestic TTI: +7.15% above its M/A (prior close +8.01%)—Buy signal effective 02/13/2019

International TTI: +6.25% above its M/A (prior close +6.97%)—Buy signal effective 10/29/2019

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details here.

———————————————————

Back issues of the ETF Tracker are available on the web.

Contact Ulli