- Moving the markets

When the Fed announced a few weeks ago that it would be buying up Treasury debt to the tune of $60 billion a month, it sure sounded to everyone on Wall Street that another round of QE (Quantitative Easing) had started. However, Fed chief Powell insisted that this is “in no sense is QE.” Yeah right.

Author Charles Hugh Smith wasn’t in agreement either and quoted in a recent post a riddle that Abraham Lincoln was known to have told: “If I should call a sheep’s tail a leg, how many legs would it have? — Five! — “No, only four; for my calling the tail a leg would not make it so.”

That is a great analogy to the Fed’s QE implantation which, despite all denials, is a bailout of some sort, most likely of the repo market, about which I have commented on from time to time. And, as this chart depicts, it may have been a panic reaction, and I am certain that this will not be the last we’ve heard about repo issues.

While the major indexes see-sawed throughout the day, the bullish bias remained intact with the Dow and Nasdaq eking out tiny gains, but the S&P slipped a fraction. These small moves were actual significant in that the usual driver, namely US-China trade news, was neutralized.

There were announcements about “progress” and “setbacks,” cancelling each other out, which is what market direction reflected. Over the weekend, we learned that top negotiators held “constructive” discussions, but other reports suggested that without rolling back existing tariffs, the outlook for a resolution looked questionable.

With trade news playing an immaterial role in the market today, traders focused on a meeting between Trump and Powell, with speculation running wild as to what these two discussed. Trump released this statement:

Just finished a very good & cordial meeting at the White House with Jay Powell of the Federal Reserve. Everything was discussed including interest rates, negative interest, low inflation, easing, Dollar strength & its effect on manufacturing, trade with China, E.U. & others, etc.

I am sure that by tomorrow morning, the computer algos may have found some more bullish meat on that bone, probably just enough to keep the ramp going. If that doesn’t work, there is always another short squeeze to be done, just like we saw today, which gave a big assist in pulling the indexes off their lows. (Source: Bloomberg)

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

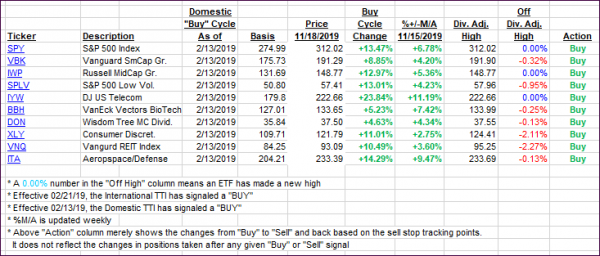

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) retreated a tad, as market direction was predominantly sideways.

Here’s how we closed 11/18/2019:

Domestic TTI: +5.97% above its M/A (prior close +6.10%)—Buy signal effective 02/13/2019

International TTI: +4.01% above its M/A (prior close +4.05%)—Buy signal effective 10/29/2019

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

Contact Ulli