ETF Tracker StatSheet

You can view the latest version here.

DIVING INTO THE WEEKEND—AND RECOVERING

- Moving the markets

It ended up being a mixed Friday, as the major indexes did an early swan dive but, despite recovering some of the losses, they still closed in the red. It was a wild week, which could have ended up far worse, but as it turned out, the S&P 500 only surrendered -0.66% with the other 2 major indexes sporting similar numbers.

Starting the session to the downside were remarks from Trump suggesting that a resolution with China was not forthcoming. He added that “things are doing very well with China,” but that “he’s not ready to make a deal.” Throwing more fuel on the fire were his remarks that next month’s talks might be cancelled.

Equities reacted very negatively, which prompted the While House to backpedal earlier remarks regarding Huawei that “we’re not doing business with Huawei.” The clarification came that “the President was referring to ONLY ban Federal Departments buying from Huawei,” and not public corporations.

The markets did an about face and quickly headed north with bond yields following suit. In the end, this provided enough ammunition to drive the major indexes back towards the unchanged line thereby averting what appeared to be an accelerating plunge in the making early on.

“Scrambling back” was the theme of the week, as volatility surged, giving an assist, at least temporarily, to the bearish crowd. The only bright and shining light all week was gold, which we added to our holdings, and which surged over 4% to conquer the $1,500 level—and having its best week in over 3 years.

We’ll find out next week, if there are more bearish surprises in store for us.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

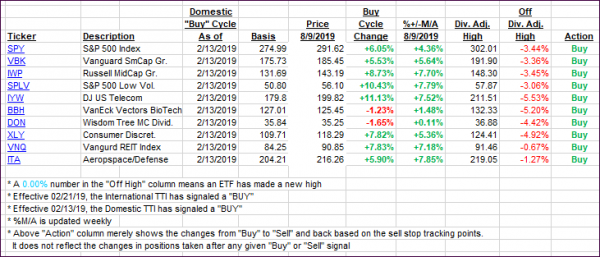

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) gave back some of yesterday’s gains with the International one closing just about at its trend line.

Here’s how we closed 08/09/2019:

Domestic TTI: +3.21% above its M/A (prior close +4.30%)—Buy signal effective 02/13/2019

International TTI: -0.05% below its M/A (prior close +0.58%)—Buy signal effective 06/19/2019

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details here.

———————————————————

Back issues of the ETF Tracker are available on the web.

Contact Ulli