- Moving the markets

A nice rebound rally, which wiped out some of yesterday’s steep losses, ran into resistance late in the session, but the major indexes managed to close in the green for a change. Trade anxieties remained and contributed to the indexes coming off their best levels

Trump stepped up to the plate again attempting to calm Wall Street traders with soothing words like it should be clear in “3-4 weeks” if a U.S. delegation’s recent trip to China was successful. This was followed by “I have a feeling it’s going to be very successful.”

He also added “when the time is right, we will make a deal with China. My respect and friendship with President Xi is unlimited but, as I have told him many times before, this must be a great deal for the United States or it just doesn’t make any sense.”

For the time being, the markets took it as a positive and pushed stocks higher. For how long that remains to be seen and how clever the administration will be in putting more lipstick on that trade pig. I suppose we will soon find out if today was nothing more than a dead-cat-bounce in an ongoing correction.

The direction of the global money supply makes that a valid argument.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

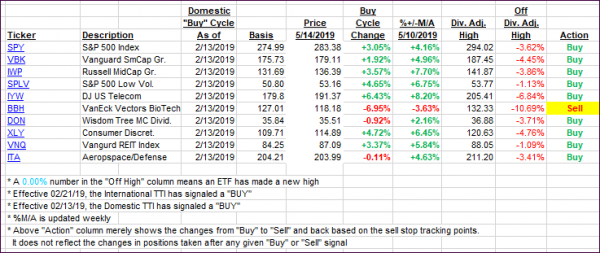

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) recovered with the markets. The International one is barely negative, and I will wait and see in which direction this indicator is headed before making any changes to our holdings.

Here’s how we closed 05/14/2019:

Domestic TTI: +2.84% above its M/A (last close +1.83%)—Buy signal effective 02/13/2019

International TTI: -0.05% above its M/A (last close -0.66%)—Buy signal effective 02/21/2019

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investmen trecommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

Contact Ulli