- Moving the markets

Right after the opening bell, equities hit the skids with the Dow dropping some 300 points before finding some footing. Causing this upheaval was the European Central Bank’s (ECB) Draghi, who unveiled a massive monetary easing program and an extended NIRP (Negative Interest Rates) period.

While that should have been a positive for equity markets, it wasn’t! Stocks stumbled, which was a reaction the market has rarely ever seen before considering that a Central Bank announced a surprisingly dovish move, even though it was in the face of a ‘substantial’ downward revision to EU growth from +1.7% to +1.1%.

So, what does that mean? Some analysts think this adverse reaction is a clear sign suggesting that Central Banks are losing control over markets by attempting to push stocks too far. The fallout was worldwide with U.S. equities following the bearish trend.

The ECBs surprise policy move sent shivers through global markets. It remains to be seen whether this is just an outlier, or a sign of things to come, but worries about a slowing global economy just reached a new high.

Since all countries are inter-connected to varying degrees, the U.S. will not be able to decouple and will experience some slowdown as well. Judging by the recent weakness in econ data points, we already have seen this process in motion; the financial markets, however, have so far been oblivious to it.

Domestically, the S&P 500 dropped below its 200-day M/A, managed to crawl back above it but ended up succumbing to bearish forces by closing slightly below it. Remember, for many Wall Street traders, this line represents the divider between bullish and bearish territory and therefore is currently seen as a critical support level which, once clearly broken, could signal the end of this current bullish phase.

Finally, ZH just couldn’t help themselves but pose the question: “It can’t be this easy, right?”

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

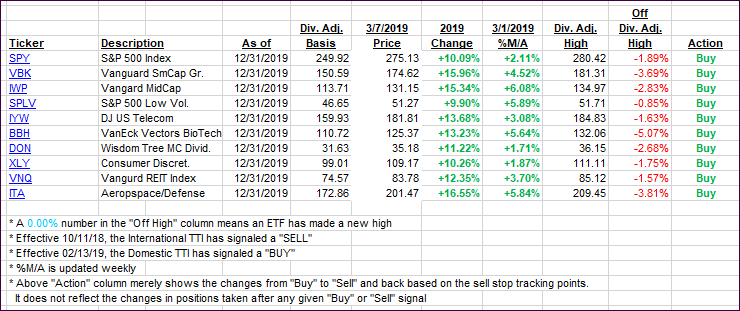

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how some our current candidates for this current ‘Buy’ cycle have fared:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) showed weakness and declined with the International one dropping below its trend line by a small margin. In order to avoid a potential whip-saw signal, I will wait and see if this break holds before issuing a ‘Sell’ signal for this arena.

Here’s how we closed 03/07/2019:

Domestic TTI: +1.09% above its M/A (last close +1.88%)—Buy signal effective 02/13/2019

International TTI: -0.37% below its M/A (last close +0.64%)—Buy signal effective 02/21/2019

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

Contact Ulli

Comments 3

Hey, Ulli

Noteworthy in today’s post: In the third paragraph, you state/imply that Central Banks are motivated solely to stimulate the stock market. Yet in the paragraph preceding that, you emphasize the “..substantial downward revision to EU growth…”. Then in the next paragraph, you mention “…a slowing global economy…” Those are the kinds of things that Central Banks respond to, don’t you think?

Please tell me, sir: do you sincerely believe that every reaction by Central Banks is motivated solely to stimulate the stock market (third paragraph, today’s post)?

Smokey

Author

It has not always been that way, but at this point in time, my answer to your question is “yes.” If not, we would not have had the desperate policy U-turn in December.

Ulli…

OK, Ulli–I give up. Your paranoia overwhelms me! ;o)

Smokey

3/8/19