- Moving the markets

Right out of the starting gates, bullish momentum ruled, and the major indexes staged an impressive come-back rally. With the results of the elections confirming a political gridlock, you may be wondering why that would be a good thing for stocks.

The Daily Bell provided this answer:

Republicans expanded their majority in the Senate, and Democrats took the House.

Surely this will cause more gridlock. Less will get done. Fewer bills will pass. Each side’s agenda will be watered down.

And that is about the best results we could hope for.

The less that gets done the better. For everyone.

Calvin Coolidge was the last President to understand this… or at least to care.

Every President tries to leave his mark on the country. But usually, it is a blemish.

President from 1923-1929, Calvin Coolidge said, “It is much more important to kill bad bills than to pass good ones.”

Apparently, the computer algos were programmed this way and pushed the markets out of their doldrums, however, on low volume. Whether this will turn into the anticipated year-end rally remains to be seen.

However, this morning, during the early stages of the rebound, our Domestic Trend Tracking Index (TTI) crossed above its long-term trend line into bullish territory. I took the opportunity to start moving a portion of clients’ assets back into equities. Usually, my action point is generated after the close, but the handwriting of a huge move was apparent. This gave us a head start on what might be a return to the bullish theme.

By the end of the day, this turned out to be the correct decision, as our Domestic TTI raced ahead and triggered a new “Buy” effective tomorrow, unless a huge correction is in the making. Absent of that, I will cautiously proceed with adding to our current holdings.

The Fed is due out tomorrow to give a verdict on interest rates. While a hike is assumed for December, none is expected tomorrow. Should that expectation turn out to be false hope, markets will likely head south and give back today’s gains.

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

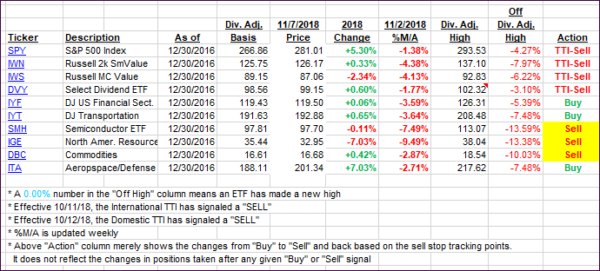

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how our candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) headed higher with the Domestic TTI crossing its long-term trend line to the upside by a substantial margin and generating a new “Buy” signal for “broadly diversified domestic equity ETFs.” The effective will be tomorrow, 11/8/2018, unless the markets retreat sharply. In that case, I will delay the effective date of this signal.

Here’s how we closed 11/07/2018:

Domestic TTI: +1.12% above its M/A (last close -0.41%)—Buy signal effective 11/08/2018

International TTI: -1.89% below its M/A (last close -3.11%)—Sell signal effective 10/11/2018

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli