- Moving the markets

Forget yesterday’s ugly close, during which the major indexes got stuck below their respective 200-day M/As indicating more pain to come on the downside. Today was a new day, where the bulls ruled for the entire session, as an upbeat earnings mood and some decent economic data (US job openings, industrial production) wiped out any bearish concerns.

At least for this session, the widely watched 200-day M/As served as a springboard to pull the indexes (except SmallCaps) out of the doldrums and back into bullish territory. While one day does not make a trend, if there is more upside follow through, we may see a resumption of the bullish theme.

Let’s not forget that the S&P 500 had dropped sharply during last seven sessions and the Dow slipped heavily in the last four out of five, pushing our Trend Tracking Indexes (TTIs) into bear territory with the Domestic one closing below its trend line, however, without having had a chance to show any staying power. That fact prompted me to unload only a portion of our domestic holdings, while waiting for more downside confirmation.

If today is any indication, we may have experienced a whip-saw signal in the domestic arena assuming this was not a one-and-done event followed by a resumption of the recent slide and volatility. If there is some stability in the making, I will again increase our current exposure to the domestic market.

Of course, market manipulation is our constant companion and today’s assist came from the fact that today was the biggest short-squeeze day since November 2016’s post Trump election rebound, according to ZH. That violent ricochet feeds on itself as constantly rising prices force more shorts into covering their positions creating more and more buying power to propel the markets higher.

Still, for October, red remains the dominant color, and we’ll have to wait and see if this optimistic rebound has legs, with earning season just dead ahead, or will simply fade away.

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

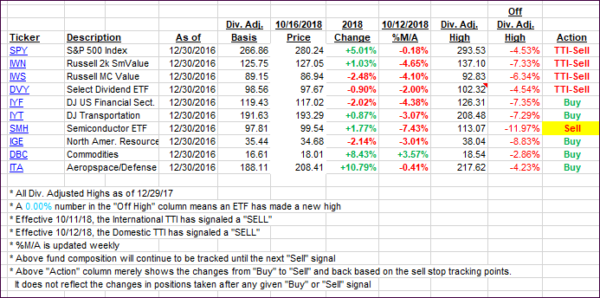

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how our candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) improved as the markets rebounded sharply with the Domestic one reclaiming its long-term trend line by a fraction of a percent. We’ll need to see more upside momentum before declaring this recent “Sell” signal to be a false move.

Here’s how we closed 10/16/2018:

Domestic TTI: +0.26% above its M/A (last close -1.71%)—Sell signal effective 10/12/2018

International TTI: -2.38% below its M/A (last close -3.85%)—Sell signal effective 10/11/2018

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli