ETF Tracker StatSheet

TESTING RECORD HIGHS

[Chart courtesy of MarketWatch.com]- Moving the markets

In the face of the worst durable goods order report in 6 months, indicating an accelerating US slowdown, the S&P and Nasdaq moved into record territory with the broad market showing a solid performance as well.

Apparently, weak economic reports, including the ones on housing recently, mean nothing compared to the impact the words of the Fed head Powell have. During the annual Jackson Hole meeting in Wyoming, which will extend into this weekend, Powell affirmed the Central Bank’s strategy that the plan to gradually normalize monetary policy will remain intact.

But, he also noted a couple of risks with further rate hikes and described these as “moving too fast and needlessly shortening the expansion, versus moving too slowly and risking a destabilizing overheating.” He ended with “I see the current path of gradually raising interest rates as the [Federal Reserve’s] approach to taking seriously both of these risks.”

This kind of reassurance, that the Fed appears to have discovered the perfect balance, pleased the markets and up we went across the board. What struck me as strange was the fact that he did not mention inflationary threats at all, as if they were non-existent. Go figure…

Even news headlines about elevated trade tensions with China, as the latest round of talks did not produce any results, could not disturb the downright sanguine mood on Wall Street. And neither did the latest legal issues of President Trump.

For a change, the much beaten up Chines Yuan staged a comeback rally, as the dollar took a dive, which in turned helped gold show signs of live with the yellow metal gaining +1.54% to $1,212, which was its best close since March. The dollar’s weakness also helped commodities (DBC) to a green weekly close.

Overall, it was a good week for equities, especially given the fact that we’re nearing the end of summer, which is a notoriously slow period for the markets. This year appears to be different.

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

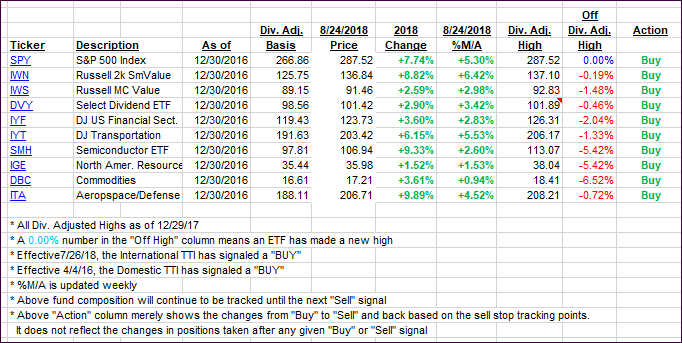

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how our candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) gained as the bullish mood prevailed.

Here’s how we closed 08/24/2018:

Domestic TTI: +3.01% above its M/A (last close +2.84%)—Buy signal effective 4/4/2016

International TTI: -0.26% below its M/A (last close -0.57%)—Buy signal effective 7/26/2018

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & As

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli