ETF Tracker StatSheet

TRADE TALK OPTIMISM CONTINUES

[Chart courtesy of MarketWatch.com]- Moving the markets

While we were off to a slow start, market direction changed in a hurry on continued optimism over the upcoming trade talks with China pushing the major indexes in the green for the second straight day. The Nasdaq lagged while the Dow closed at its highest since February.

The upcoming trade talks with China were reinforced by optimism that a mutually beneficial solution will eventually be found, which proved to be again the force that supported upward market momentum. Especially, news of a road map to reach a deal that could lead to a summit between Trump and Xi Jinpin later this year helped the positive sentiment.

Putting a bit of a downer on the mood on Wall Street were the latest headlines from Turkey, as their currency headed south again at the tune of 4%. It appears that the story is far from being over and will continue to create market headwinds, the severity of which will depend on the magnitude of the events.

Not helping matters was Moody’s, which joined S&P and Fitch in downgrading Turkey’s long-term foreign debt rating to Ba3 from Ba2 and shifting their outlook to “negative” from “watch negative.” Then S&P unleashed the truth by forecasting “a recession next year. Inflation will peak at 22% over the next 4 months, before subsiding to below 20% by mid-2019.” Ouch!

Despite global turmoil in the markets, with global stocks being down 14% from their all-time highs in January, US equities have been dominating YTD as this chart shows. That means we are still the cleanest dirty shirt in the dirty laundry basket, which to me begs the question is “how long can we remain isolated?”

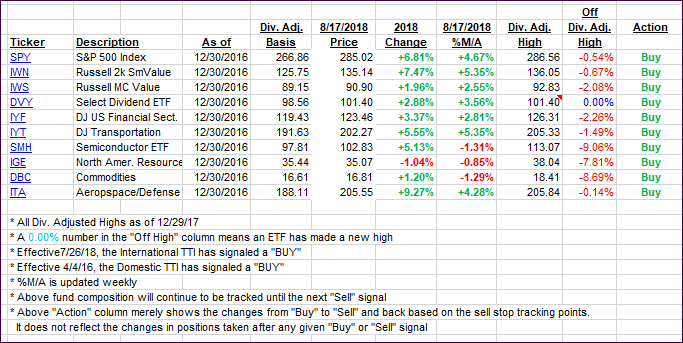

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how our candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) were mixed with the Domestic one sliding a tad while the International one moved closer to its trend line.

Here’s how we closed 08/17/2018:

Domestic TTI: +2.54% above its M/A (last close +2.57%)—Buy signal effective 4/4/2016

International TTI: -1.38% below its M/A (last close -1.76%)—Buy signal effective 7/26/2018

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & As

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli